Iranian Tanker Released, US Cracks Down on Sanctions

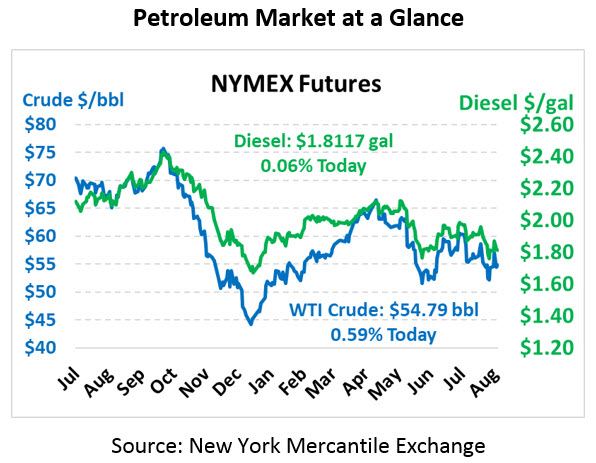

Markets once again dropped yesterday amidst weakened economic prospects, and today prices are trading relatively flat. Crude prices are currently $54.79, up 32 cents.

Fuel prices are also in the green, though with mixed degrees of exuberance. Diesel prices are trading flat at $1.8117. Gasoline prices are leading the market higher, trading up 1.4 cents to $1.6505.

OPEC released their Monthly Oil Market Report (MOMR), which highlighted continued demand weakness in 2019 and 2020. The group cut its forecast 40 kbpd, which is relatively small but fit the continued narrative of economic weakening. Additionally, OPEC cut its global GDP growth expectations from 3.2% to 3.1%. On the flip side, the group also expects less supply in 2019, cutting its forecast by 72 kbpd.

Also in the Middle East, the Iranian oil tanker captured weeks ago for violation of sanctions has been released by Gibraltar, though the US has tried to extend its seizure on charges of assisting the Islamic military. European forces originally captured the ship on its way to Syria, a country sanctioned by the EU; since then, Gibraltar claims Iran has committed to delivering the oil to a different location.

Continuing the sanctions news, the US is cracking down on Venezuela sanctions by considering sanctions on Russian oil company Rosneft. Rosneft has been purportedly trading fuel with Venezuela in exchange for crude oil. The US will have to walk a fine line, though, as Rosneft is a massive oil company and sanctions could severely disrupt global oil markets. Seeing America’s crackdown, Chinese oil company PetroChina cut off purchases of Venezuelan crude for the first time in a decade.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.