Late Hurricane Season Will Bring More Activity

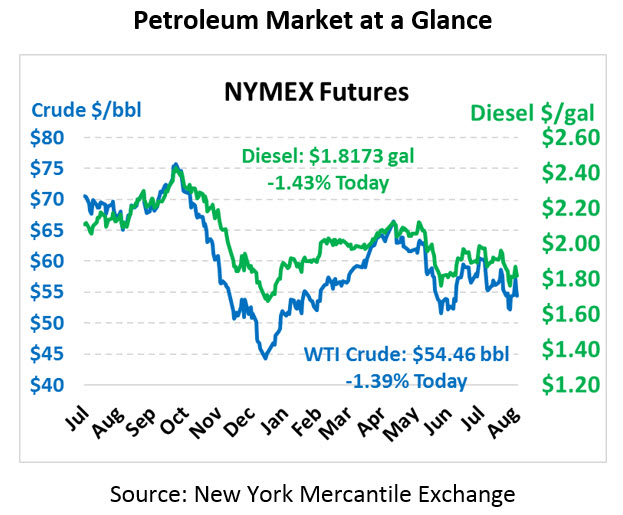

In a continuation of yesterday’s losses, oil prices are trading lower this morning. Crude oil prices are trading at $54.46 this morning, down 77 cents from Wednesday’s close.

Fuel prices are also falling today. Diesel prices are currently $1.8173, down 2.6 cents. Gasoline is trading at $1.6425, down 3.3 cents.

The EIA report was mostly in line with the API estimates. The crude build was smaller than the API estimated, as was the gasoline draw. Inventory numbers could not alter the momentum of the market which dropped nearly 3% yesterday on poor economic news coming from China and Europe.

Hurricane Season to Pick Up Steam

Hurricane season runs from the beginning of June to the end of November. June and July have been relatively quiet because dry dusty air from the Sahara have robbed potential storms of moisture and wind shear originating from El Nino climate systems have ripped apart budding storms. Those climate effects are no longer in play and we expect to see a much more active weather pattern in the next few weeks.

The next six weeks – dubbed the “season within a season” – is usually the most active and dangerous time for storms in the Atlantic. Weather patterns are shifting to make conditions quite conducive for storm formation and strengthening.

What do these weather systems mean for us? We can expect a back loaded hurricane season with 10 to 17 named storms affecting shipping and coastal fueling infrastructure. More than 45% of U.S. refining capacity is along the Gulf of Mexico coastline. Last year, hurricanes Florence and Michael caused more than $49 billion in damage. Let’s hope for better luck with storms this year.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.