Despite Massive Inventory Draw, Iran Dominates Prices

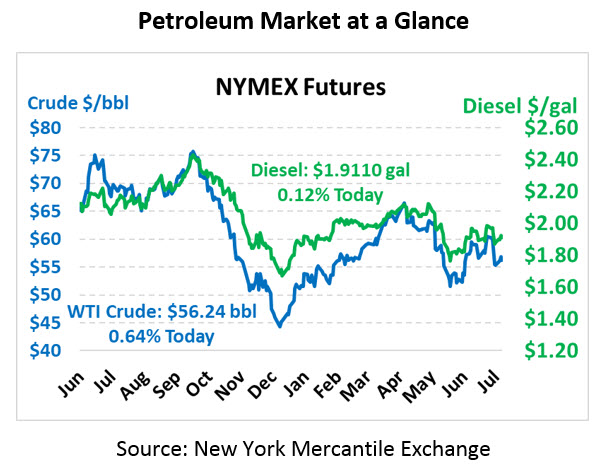

Oil prices got a lift following yesterday’s EIA report but quickly sank lower after the initial surprise from the headline draw wore off. Today, though, markets are getting a lift from the European Central Bank holding interest rates steady, which is supportive for economic markets. Even this morning’s gains, though, are falling back, with prices coming off nearly $1/bbl gains. Crude is currently trading at $56.24, up 36 cents since closing yesterday.

Fuel prices are also trading a bit higher, with gasoline clearly leading the market higher. Diesel prices are currently trading at $1.9110, up a mere 0.2 cents. Gasoline, on the other hand, is trading at $1.8811, a 2.6 cent (1.4%) gain since yesterday.

The EIA’s report was actually more bullish than the API’s, showing a comparable crude draw but no surprise build in gasoline stocks. The large numbers have been attributed to Tropical Storm Barry, which caused production to temporarily fall offline while also preventing imports into US Gulf ports. But the draw was also felt around the country, so Barry’s impact on the Gulf Coast was only part of the story. Exports remained high, and refinery utilization was up around the country except in PADD 3 (Gulf Coast). Even without Barry’s impact, the crude draw would have been around -2 MMbbls, enough to sustain the destocking mode inventories are now in.

The EIA’s data was not enough to keep markets elevated, and de-escalation of Iran tensions caused markets to quickly revert lower. Iran has formally offered a tanker exchange with Britain, which could be the first step in the Western world restarting dialogue with Iran over its nuclear program. So far, Iran has only offered to resume nuclear talks if America fully lifts the sanctions it has imposed. Of course, with a new Prime Minister in the UK, who knows how the country’s foreign policy could evolve over the coming week. Long live the Queen!

In other Middle East news, Saudi Arabia and Kuwait announced significant progress on producing oil in the Neutral Zone on their shared border, which has the capacity to produce 500 kbpd at full capacity. The Neutral Zone, which covers an area of land roughly comparable to the state of Delaware, saw production cut off in 2015 when Kuwait protested Saudi Arabia’s grant of long-term oil permits. Bloomberg reports that remaining issues are merely technical, not structural, indicating production could resume soon. It’s unclear whether that will occur, though, since both countries are subject to OPEC’s production cuts until Q2 2020.

Notably, the Neutral Zone area, specifically the Wafra oil field under contest, is known for its heavy sour crude output, which could help replace some of the barrels lost to Iran and Venezuelan sanctions. Major producers such as the US and Europe are known for their light sweet crude oils, which have low sulfur content and less heavy elements. While light sweet crude is ideal for gasoline output, heavier crude have more middle and heavy components, making them well-suited for diesel and marine fuel output. The US has been urging the Saudi Arabia and Kuwait to resolve their differences to enable more heavy crude to reach the market, since many Gulf Coast refineries are optimized to process heavier foreign crudes.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.