Oil Breaks Higher on Crude Draw

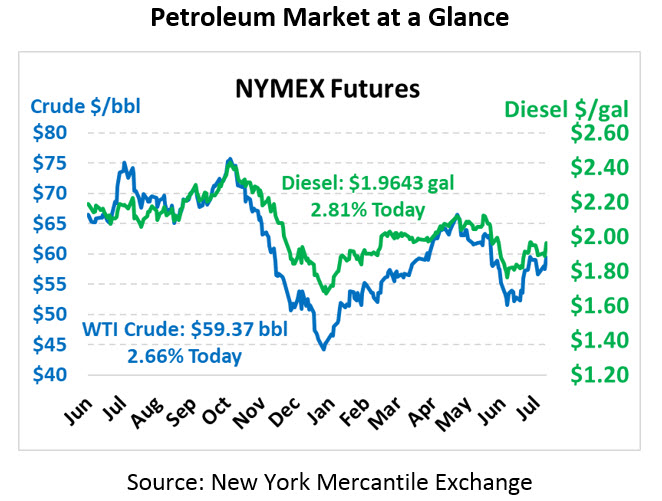

Prices are trading strongly higher this morning following supportive data from the API. Markets have been relatively flat all week, so today’s breakout higher is the first sign of clear market direction. Crude oil is currently trading at $59.37, up $1.54 (2.7%).

Fuel prices are also strongly in the black. Diesel is trading at $1.9643, up 5.4 cents (2.8%) from Tuesday. Gasoline is up 3.9 cents (2.0%), trading at $1.9659.

The API’s report yesterday hinted at a strong crude oil draw, and markets appear to view the numbers as highly credible. While markets expected just a 3-million-barrel crude oil draw, the API put that number closer to 8 million barrels. Perhaps more noteworthy, the API is calling for a moderate draw in Cushing crude stocks, which would be particularly supportive for WTI contracts. Diesel stocks did rise more than expected, but markets are looking past that. Now markets will wait to see if the EIA’s report confirms the bullish data.

In the Gulf Coast, Invest92 is expected to form into a named storm (Berry) over the coming days, impacting offshore oil rigs and requiring a temporary operational halt. Current models show the pattern reaching Tropical Storm levels (potentially briefly reaching Hurricane strength) before hitting somewhere along the Gulf Coast, with most trajectories showing a Louisiana landing. Flooding may occur along the coastline, though at this point there’s no indication the storm will stall to dump rain on any one area. At this time no severe fueling impacts are expected, but Mansfield is tracking the storm closely to monitor any changes in conditions.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.