Today’s Market Trends

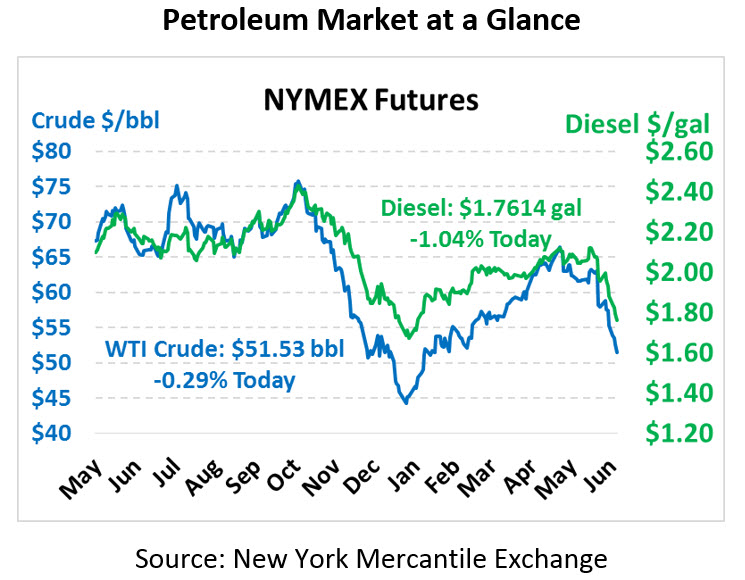

Markets are continuing to reel from yesterday’s EIA report, though the losses have slowed somewhat. Brent briefly sank below $60 yesterday before rebounding. WTI Crude is currently trading at $51.53, down 15 cents after falling $1.80/bbl on Wednesday.

Fuel prices are mixed this morning. Diesel continues to face pressure following the large reported build, trading at $1.7614 which is 1.9 cents below yesterday’s closing price. Gasoline prices are trading at $1.7050, up 1.2 cents.

The EIA’s analysis yesterday left markets with a bearish taste in their mouth, leading to a continued sell-off for oil contracts. Across all products, stockpiles rose by 22 million barrels, the largest jump going back to 1990 thanks to hefty imports and record crude production. Crude oil inventories accounted for a quarter of that, with a large counter-seasonal build in inventories. Gasoline demand has been trailing behind last year’s levels, roughly 200 kbpd lower than the same week in 2018.

In international oil news, Russian President Putin hinted that the country would be “just fine” with international Brent prices close to $60-$65, which may lead the country to balk at extending OPEC+ cuts longer into 2019. On the demand side, tariffs with Mexico are continuing to create controversy, particularly amid speculation that Mexico may retaliate by applying tariffs on US refined fuels. Such a move would cause inventories to rise even higher than they are today, putting significant pressure on US prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.