Merrill Sees “Greater Risk to Upside” After Technical Drop

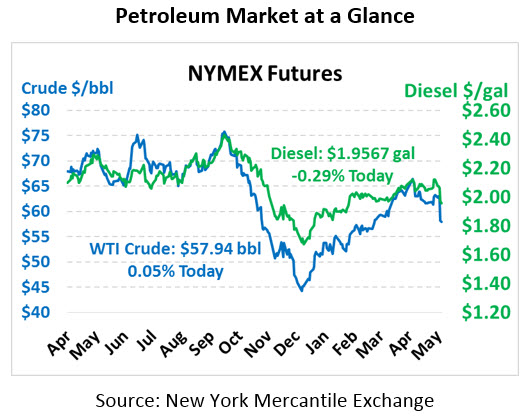

Oil markets have stabilized somewhat after yesterday’s precipitous drop in prices. All in, the decline saw prices fall $3.50/bbl, the largest drop since December. Fun fact – the largest price drop in WTI crude history was a $14.31 drop on September 23, 2008; in the last five years, the largest drop was $7.54 on November 28, 2014. So while yesterday’s drop was by no means catastrophic, it certain left traders nervous for the future. This morning WTI crude is trading at $57.94, little changed following yesterday’s hefty activity.

Like crude, fuel prices have been trading mostly flat to yesterday’s numbers. Diesel is currently trading at $1.9567, a slight 0.6 cents below yesterday’s close. Gasoline prices are $1.9116, roughly flat with Thursday’s ending price.

The steep drop in oil prices seems more technical in nature than fundamental. While the EIA’s data helped spur lower prices, a massive drop a full day later would need other causes. Many point to the fact that crude broke below its 200-day moving average level ($60.50) for the first time since April, leading technical traders to sell their positions to lock in profits. If that’s the case, then markets could rebound if and when prices break above the key threshold once again. Weakness was also driven by overall financial market weakness, with the S&P sliding 1.2% as well amid trade war concerns.

On the recent decline in prices, Merrill Lynch this morning reported that yesterday’s drop represents a “bottom end” for range-bound prices and sees “greater risk to the upside” in months ahead. Specifically, with OPEC waiting until July to make a decision on continued production cuts, lower prices would almost certainly push them to continue their market balancing act.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.