Supply Outages Threaten 2019 Prices

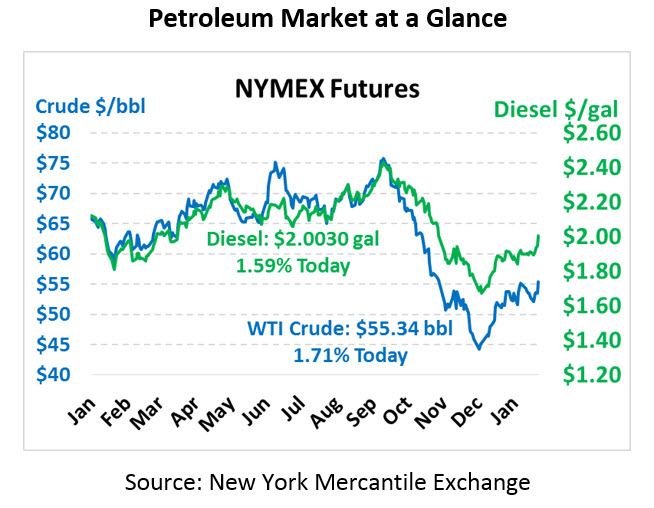

The oil complex ended on an upswing yesterday, with crude closing just shy of $55/bbl while fuel prices closed that their highest level since before Thanksgiving. Crude oil is currently trading at $55.34, a gain of 93 points from yesterday’s close.

Fuel prices are also trading higher this morning. Diesel prices are currently trading at $2.0030, up 3.1 cents from yesterday. Gasoline prices are well above $1.50 now, trading at $1.5459 after gaining 3.7 cents.

Oil markets are moving higher on news of global supply risks. Saudi Arabia had a cable power issue at a crude oil field that produces 1.5 million barrels of crude each day. Though the kingdom has plans to increase production elsewhere to compensate, the outage highlights the fragility of global supply. While outages of this nature tend to be resolved in a few weeks, prolonged repair could weigh heavily on oil markets. In addition, Nigerian rebels have threatened oil production if the current Nigerian President Buhari is re-elected later this year. Just a few years ago, the rebel group caused a 1 MMbpd production outage, and they have the capability to inflict similar damage this year.

Merrill Lynch yesterday set their 2019 Brent price target to $70/bbl, expecting OPEC cuts to keep steady upward pressure on prices this year. With WTI generally trading about $10/bbl below international Brent oil prices, the forecast suggests $60/bbl average for American crude oil, though the gap may narrow later in the year as export infrastructure develops.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.