Oil Price Bottom behind Us?

Oil is continuing its streak of gains this morning as prices hit new post-Christmas highs. Prices are pushing rapidly back to $50/bbl, and many expect them to continue rising to $60 during Q1. This morning, crude oil is trading at $48.57, a gain of 61 cents.

Although gasoline prices fell on Friday and diesel saw just modest gains, this morning brings modest gains to both products. Diesel prices are $1.7984, up 2.9 cents from Friday’s close after briefly trading above $1.80. Gasoline prices are trading at $1.3711, a 2.3 cent gain.

Now that prices have been rising, can we call a bottom to the recent bear market? It’s likely too soon to tell, but there certainly are not many fundamental drivers that justify a return to $45/bbl. While oil inventories rose towards the end of 2018, they remain far below 2016 levels when supply was abundant. With OPEC+ and Canada making output cuts this year, all signals point towards balanced markets in the coming months and higher prices. Of course, markets don’t always follow rationality in the short-term, but over the long-term prices should keep making their way higher.

US-China Trade Talks Resume

Markets are looking hopefully to Beijing, where US-China trade talks pick up after a month of silence. In early December, Trump and Xi met and agreed to a 90-day trade truce, which expires March 1. If the two nations cannot come to an agreement, Trump has threatened to increase tariffs further. Both countries seem eager to reach a deal, which would bring new strength to languishing economic growth prospects.

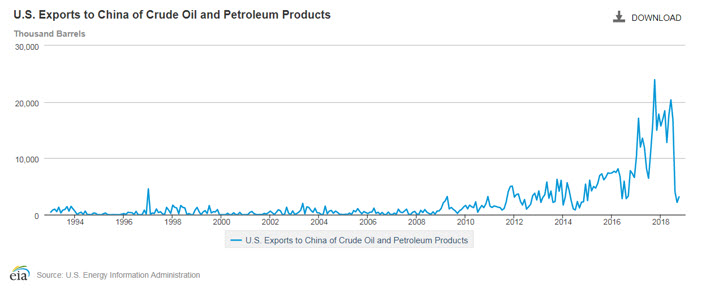

For American oil prices, progress on US-China trade talks is particularly important. China has grown to be one of America’s largest oil export destinations, but exports nosedived in August as the trade war loomed over the market. Chinese refiners have been searching for alternative supply sources, unsure whether oil will eventually be dragged into the conflict. A definitive answer from policymakers would help normalize US oil exports to China, which would boost WTI crude prices and help the US economy. Of course, the downside is higher fuel prices, which puts a burden on consumers.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.