After Early Weakness, New Year Market Surges

Happy New Year!

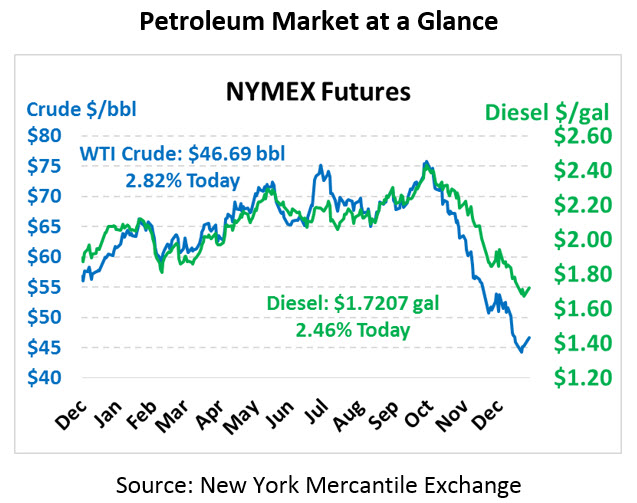

Oil prices began the year early this morning on a weak note, with oil prices once again dipping below $45/bbl. That changed later in the morning, as markets reversed course with a sharp rally higher. Many analyst groups are calling for a Q1 2019 rebound in prices, but it’s yet to be seen whether that rally will occur early in Jan or will wait until later to materialize. This morning WTI crude oil is trading at $46.69, a gain of $1.28 (2.8%).

Fuel prices are also rallying, despite diesel prices setting fresh lows earlier in the day. Diesel is currently trading at $1.7207, up 4.1 cents (2.5%) from Monday’s close. Gasoline prices are leading the charge higher, trading at $1.3580, a gain of 5.6 cents (4.3%).

Despite positive comments from President Trump on US-China trade, recent data paints a tougher story in the short-term. China’s factory activity fell to a 19-month low, and the country is cutting its crude oil import quotas for 2019 to below 2018 rates. On the supply side, though, Russia set a new monthly production record in December, while US production continued climbing. Countering excessive supplies is the OPEC+ deal cutting production from signatory nations by 1.2 MMbpd.

A new year brings changes in taxes, regulations, and incentives. With the government still shutdown, policy making in Washington is slow, but that doesn’t mean states can’t take action on their own. Here are a few legal changes taking place on Jan 1:

- Federal Oil Spill Fee – The federal fee of 9 cents per barrel ($.0021/gal) which funds the government’s Oil Spill Liability Trust Fund expired on December 31, 2018. Last year, the fee expired and was re-imposed later by Congress. Mansfield has discontinued invoicing the Federal Oil Spill Fee to all customers effective Jan 1, 2019 at 12:01 AM. Mansfield reserves the right to thereafter resume charging the Federal Oil Spill Fee, including any retroactive Fee that Congress may impose

- IL Bio Incentive – Effective January 1, 2019, B1-B10 biodiesel blends are no longer exempt from the 6.25% sales tax rate. B11 and above blends will still be eligible for the tax exemption.

- State Fuel Tax Hikes – With fuel prices down, you may have missed some slightly higher fuel taxes imposed in a few states.

- Florida: Gasoline and diesel taxes increased by 0.4¢/gal, and the state also increased its rate for the State Comprehensive Enhanced Transportation System (SCETS) fee by 0.2¢/gal

- Nebraska: Gasoline taxes rose by 1.6¢/gal, bringing the total tax to 29.6¢/gal

- Utah: State motor fuel tax rose by 0.6¢/gal to 30¢/gal

- North Carolina: State motor fuel tax rose by 1.1¢/gal per the state/s tax rate formula, bringing the total cost to 36.2¢/gal

- Georgia: Rates are up based on automatic fuel tax adjustments. Gasoline taxes rose 0.7¢/gal to 27.5¢/gal, while diesel taxes rose 0.8¢/gal to 30.8¢/gal

- Automatic Adjustments in other states could result in moderate fuel tax changes of a penny or less in areas such as Indiana, Iowa, New York, and West Virginia. These states have formula-based rates that are adjusted either annually or more frequently.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.