3-2-1… Go!

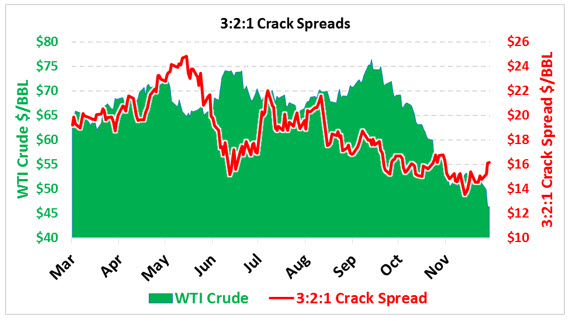

Crude is by far the most significant driver of fuel prices, but at times the two products can become delinked. Over the past 9 months, 3:2:1 crack spreads – the difference between the price of crude and the price of the gasoline/diesel it creates – has been trending lower. Recall that three barrels of crude roughly create two barrels of gasoline and one barrel of diesel. Since July, fuel prices have generally been falling even faster than crude oil.

Yesterday’s selloff, though, caused 3:2:1 spreads to rally by nearly $2/bbl. While crude oil lost over 7%, fuel prices gave up just 4%. The decline in spreads come even as diesel has been a relatively strong performer. However, because refiners produce more gasoline than diesel from a barrel of crude, gasoline has a heavier weight.

Spreads are driven by changing supply/demand dynamics. For instance, although crude and gasoline stocks are plentiful, diesel markets are quite tight. Gasoline stocks are even farther above their 5-year range than crude stocks, putting downward pressure on 3:2:1 crack spreads which assume a barrel of crude produces 2 parts gasoline and 1 part diesel.

Unlike fuel stocks, crude has closely tracked its 5-year average for most of this year, but recent months have seen stocks climb higher. While still not nearly as high as stocks were in 2017, when prices were locked in the $45-$55 range, stocks are starting to break higher. Markets currently fear that despite OPEC cuts, we’re heading back towards a supply glut. Although OPEC is likely to take action to prevent another glut, it’s possible that inventories could swell in the coming months, causing prices to remain low.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.