As WTI Hits $46, Saudis Bet on $80 Crude

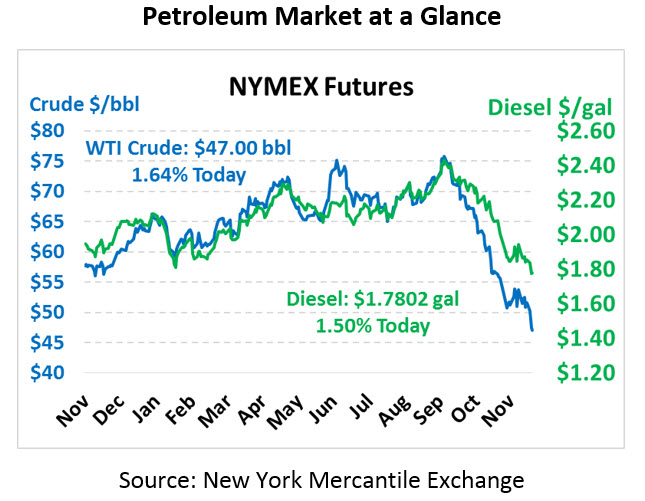

Yesterday brought another unpredictable sell-off, sending prices cratering to $46/bbl (a 7.3% loss) – within striking distance of the $45/bbl threshold that was a long-term floor even when prices were trading in the $45-$55 range. This morning crude is trading decisively higher, up 76 cents (1.6%) to $47.00.

Fuel price losses were not as severe as crude’s, but the products still took a hefty hit. Diesel sank to $1.75 yesterday (down 4.0%), while gasoline closed the day at $1.35 (losing 4.3%). This morning, diesel prices are garnering some support from the API’s data, trading up 2.6 cents (+1.5%) to $1.7802. Gasoline prices are also in the black, trading at $1.3691 after picking up 1.9 cents (1.4%).

The API reported its weekly inventory data late yesterday, showing a surprise crude build countered by a surprise drop in distillate stocks. Lately the API’s data has been a poor predictor of the EIA’s more authoritative data (released later this morning), so markets are taking the report with a grain of salt.

Looking internationally, Saudi Arabia is betting their budget on oil prices reaching $80/bbl this year – a far cry from current levels. Do they know something we don’t? The country plans to cut its output to 10.2 MMbpd in 2019 – almost a million barrels below its current production levels but still higher than its quota in 2018. According to Bloomberg, though, Brent crude is expected to average $73/bbl next year, not quite enough to keep the Saudi budget whole.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.