Week in Review

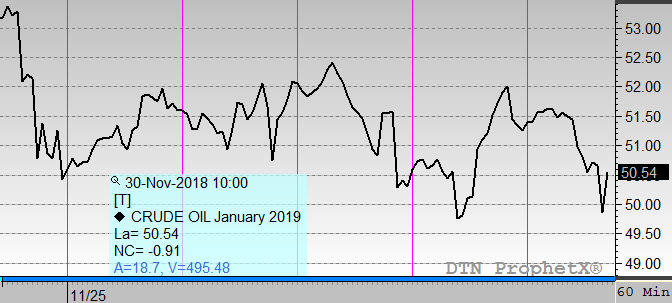

For the first time in a while, oil prices did not fall lower this week, though that speaks more to the extremely weak opening price than to any market strength. The trade has tested a rally a few times this week, but prices seem to stick around $52 before sinking back to $50. That up-and-down pattern has dominated the patterns this week, though a G20 meeting today and the OPEC meeting next week should provide more clarity to the market in the days ahead.

After several hard drops from $75/bbl down to just $50/bbl, traders are wondering whether $45 is the next step in crude’s path. As we noted earlier this week, the trek from $55 to $50 was driven largely by put options that caused significant selling once prices broke that threshold. The fact that prices have not held below $50 this week seem to indicate that markets aren’t interested in moving any lower.

Prices in Review

Crude began the week at $50.62, at the time the lowest opening price in years. The product made a few attempts at rallying, but each one was quickly squashed by sellers taking advantage of the rally. Rallying to $52 on Wednesday, the EIA’s bearish report caused oil to turn lower settling below $52 on Wednesday and setting a new multi-year low on Thursday when prices briefly fell below $50. This morning crude opened at $51.27, a very small weekly increase of 65 cents.

Diesel prices took a big hit this week, much to the benefit of consumers. While gasoline has been steadily falling for a while, diesel generally showed strength through the bear market until the last two weeks. In just two weeks, diesel has fallen from above $2.00/gal to below $1.80. This week, diesel opened at $1.8776, coming off the tail of a ten-cent drop last Friday. This morning diesel opened at 1.8406, a loss of 3.7 cents.

Gasoline prices are trending up the highest across the petroleum complex, thanks to a mid-week report from the EIA showing a surprise draw from gasoline inventories. Gasoline opened at $1.3917 and sank to a fresh low at yesterday’s open, but has since climbed to open this morning at $1.4461, a 5.4 cent gain.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.