Cyber Monday Trading Lifts Sunken Oil Prices

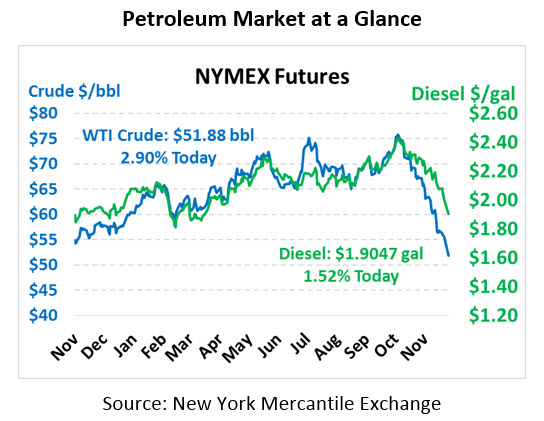

Friday’s oil trade certainly did not feel like a holiday week, with volumes once again spiking while prices fell rapidly. Oil opened on Friday at $54.66 but plummeted to close at $50.42. This morning, traders are feeling the Cyber Monday excitement, with prices rebounding from Friday’s lows. Crude oil is trading at $51.88, up $1.46 from Friday’s close.

Fuel prices are also trading higher. On Friday gasoline fell almost 12 cents, while diesel prices shed 9.4 cents. This morning gasoline is trading at $1.4466, up 5.5 cents. Diesel prices are $1.9047, up 2.9 cents from Friday’s close.

Oil markets are looking ahead to the G20 meeting at the end of the week – a gathering of the 20 largest economies in the world to discuss global economic trends. The meeting itself is not the star of attention, but rather a sideline meeting between President Trump and Chinese President Xi Jinping to discuss trade policy. Many are hoping that some kind of progress comes from the meeting, though there’s a high likelihood that the meetings will end with zero momentum. Some are viewing this as the last chance for the two countries to work out their differences – if the top leaders of both countries cannot resolve the dispute, there’s little hope for resolution in 2019.

With oil prices sustaining their losing streak, OPEC is even more likely to take action in the December 6 meeting. On Thursday the Saudi oil minister said the country would take action to calm markets’ fears of excess supplies. Markets are expecting OPEC to cut production by 1.4 million barrels per day back to their original November 2016 agreement levels. Since those quotas were put in place, OPEC has grown lax in enforcement, letting production creep back up to pre-quota levels. Despite decreased output from Venezuela and Russia, OPEC’s overall production has been rising.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.