Here Comes the Halloween Effect!

A simple holiday can’t significantly alter the oil price environment – can it? Keep reading below.

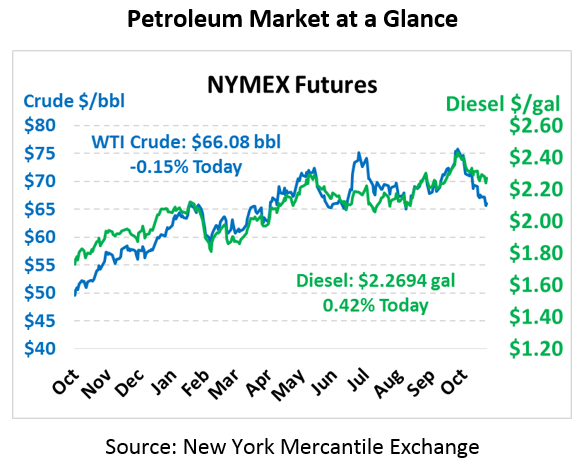

Crude ended the day significantly lower yesterday, almost a dollar below Monday’s closing price. This morning, prices are unmoved despite a supportive API inventory report. Crude oil is currently trading at $66.08, trading down just 10 cents from yesterday’s close.

Fuel prices are also in mixed territory after both products saw losses around 2 cents yesterday. Diesel prices are currently $2.2694, up 1.0 cents since closing yesterday. Gasoline prices are trading at $1.7921, down 1.4 cents.

The API’s report showed a larger-than-expected crude oil build of 5.7 million barrels, but fuel draws were disproportionately larger, making the net effect of the report slightly bullish. Given that markets are overall feeling a bit bearish right now, it will take more than a small net draw in petroleum products to lift the market up higher this week.

Will Markets See a Halloween Effect?

Traders are always looking for a recurring pattern to help inform trading strategies – leading them to track patterns such as Moving Averages, Ascending Triangles, Fibonacci Arcs, and more. One popular trading mantra is “Sell in May and go away” – based on the Halloween Effect.

Markets historically perform better from October to May than in the other half of the year. While the reasons behind this are disputed, the results can be seen in a historical analysis of energy markets. In particular, for WTI crude (among other crude blends) the Halloween Effect is statistically significant. Other products, like natural gas, experience a reverse-Halloween effect – nat gas prices rise leading up to October and fall going into summer months like May. Notably, Brent crude (the international oil index) does not show any statistically significant Halloween effect.

How should energy consumers interpret this information? It’s no surprise that gasoline prices fall towards the end of summer when summer gasoline spec requirements expire. This effect generally trickles up to crude oil – stronger summer demand causes prices to rise around April/May, causing the apparent “pop” in prices from October to May. Conversely, weak winter demand cause prices to decline rapidly in October/November (which we’ve certainly experienced this month with refinery maintenance). The bearishness we’re seeing in markets right now appears at least somewhat caused by seasonality – although there could be some larger trends at play, an October decline does not necessarily predict broader losses.

Haunted Round-Up

PSC: Is Oil the Key to a Happy Halloween? [Disclaimer: this article contains scary images of clowns and is not for the faint of heart. Also, it might make you question eating candy corn]

API: Jack-O-Lanterns and a High Energy Halloween

Wilkerdos: Forgot to Make a Halloween Costume? Be an Oil Rig!

Ellen R. Wald: Last, if you don’t want to dress as an oil rig – use this handy guide! Your FN writer is going as a Sassy Keystone XL Pipeline

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.