Global Supply/Demand Reaches 100 MMbpd

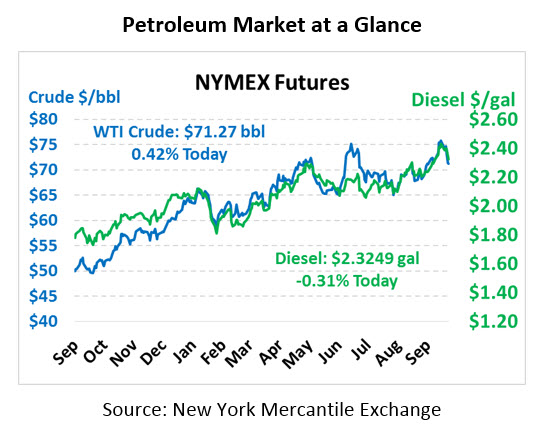

Oil prices are rallying this morning as traders swoop in to buy the dip in oil prices. Yesterday saw some of the large price movements of the year, with crude falling over $2/bbl yesterday following a bearish inventory report. This morning, crude prices are getting a boost, trading up 30 cents at $71.27.

Fuel prices also took a massive hit yesterday. Gasoline prices took an overwhelming 8.8 cent hit, while diesel prices declined 6.3 cents – among the largest oil complex declines this year. This morning, diesel prices are trading at $2.3249, down 0.7 cents from yesterday’s close. Gasoline prices, by far the biggest loser yesterday, is trading at $1.9344, up 0.2 cents.

This morning the IEA released their monthly oil market report, which brought a downward revision to demand forecasts and upward revisions to supply – putting markets in balance for 2019 with the exception of surprise outages. Notably, IEA report showed that global oil supply and demand surpassed 100 million barrels per day in September – a “historically significant” milestone for markets. Despite decades of speculation that peak supply or peak demand would crash oil markets, markets keep on growing. Below is an excerpt from the IEA’s report:

It is an extraordinary achievement for the global oil industry to meet the needs of a 100 mb/d market, but today, in 4Q18, we have reached new twin peaks for demand and supply by straining parts of the system to the limit. Recent production increases come at the expense of spare capacity, which is already down to only 2% of global demand, with further reductions likely to come. This strain could be with us for some time and it will likely be accompanied by higher prices, however much we regret them and their potential negative impact on the global economy.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.