Week in Review

This past week was defined by the across-the-board stock draws showed by the EIA, as well as surprisingly high gasoline and jet fuel demand. Those factors combined to give oil prices a strong positive boost, bringing us close to the $72/bbl resistance threshold we’ve mentioned a couple times in the news.

On the economic front, North American trade has been a huge focal point this week. After announcing a bilateral US-Mexican agreement on Monday, Trump gave Canada until Friday to sign on to the agreement, which would replace NAFTA. Canada has held firm on certain provisions such as protecting its dairy sector, but overall rhetoric has been positive that a deal can be arranged. Canadian PM Justin Trudeau said he was hopeful the deal would come together, but also noted, “No NAFTA deal is better than a bad NAFTA deal.”

Prices in Review

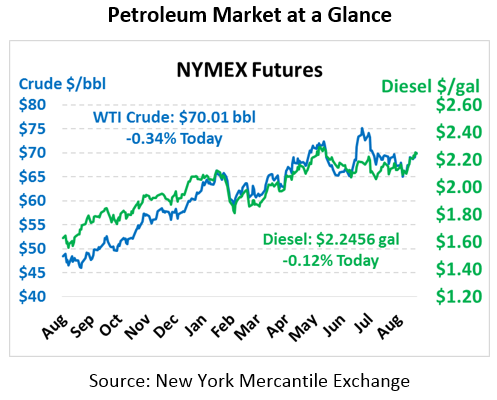

Crude oil began the week at $68.57, and saw some downward pressure on Tuesday following the API’s report of very meager changes in inventory levels. The EIA’s data controverted the API’s, showing large draws in inventories that sent prices soaring. By Thursday, prices had surpassed $70/bbl for the first time in a month. Crude has followed a pattern all summer of rising slowly, and dropping quickly. As we creep above $70 again, we’ll see if that price level holds this time. Prices opened this morning at $70.06, a gain of nearly $1.50 (2.2%).

Diesel prices opened the week strongly, at $2.1993, the highest opening since early July. Diesel prices enjoyed strong support throughout the week, reaching its peak on Thursday as the contract pushed $2.25 highs, a level not seen since May’s high water mark of $2.30. Friday saw prices come off the highs a bit, opening at $2.2454, a gain of 4.6 cents (2.1%).

Gasoline saw some of the largest gains this week as demand hit an all-time weekly high. Gasoline prices began the week at $2.0735, trailing far behind diesel prices. Prices began rising rapidly on Wednesday, then continued to experience strong gains on Thursday. On Friday, gasoline opened at $2.1435, a gain of 7 cents (3.4%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.