OPEC Increases Production without Firm Commitments

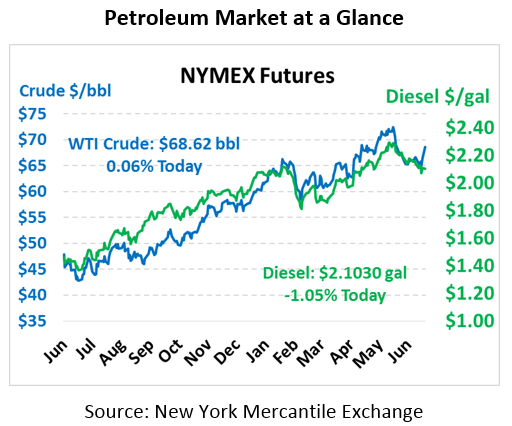

Oil prices soared higher on Friday after OPEC announced a weaker-than-expected increase in output. WTI gained $3/bbl (4.6%) on Friday as markets realized that OPEC still prefers higher prices and will not simply ratchet up production to keep prices lower. Today, crude prices have gained another 4 cents, trading at $68.62.

Fuel prices also got a huge boost on Friday, though today prices are trending a bit lower. Diesel picked up 5.5 cents on Friday, while gasoline added 5.8 cents. This morning, prices are giving up some of their gains. Diesel prices are trading at $2.1030, down 2.2 cents since Friday’s close. Gasoline prices are at $2.0543, down 1.6 cents.

Markets are, of course, reacting to OPEC’s decision to increase production by 1 MMbpd. Although the increase looks large on paper, the reality is as much as 60% of that figure comes from nations who cannot readily increase their production output. Saudi Arabia has committed to “measurable” output increases, but gave no clear indication of hard numbers.

It should not be surprising that OPEC is not making any firm commitments. OPEC wants prices as high as possible, so member countries can balance their state budgets. When committing to production cuts, OPEC was glad to provide highly specific details and firm commitments to boost prices. Now that they’re increasing production, muddy waters are more to their benefit. While the output increases will likely materialize, OPEC benefits from market uncertainty in the short term.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.