Today is the Day

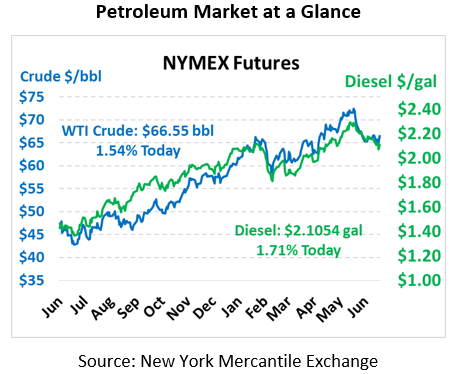

Oil markets are moving higher as the highly anticipated OPEC meeting takes place in Vienna this morning. After some early morning losses, crude prices were able to find strength and end the day 20 cent higher during yesterday’s trading session. Today, oil prices are continuing their upward momentum, trading $1 higher than yesterday’s closing price, at $66.55.

While crude prices received moderate support yesterday, fuel prices decreased. Gasoline fell only half-a-cent, but diesel lost over 2.5 cents yesterday. Today, however, the products are reversing their losses and trading higher. Diesel prices have gained 3.5 cent to trade at $2.1054 currently. Gasoline has picked up just under 3 cents, trading at $2.0410 this morning.

Today is the Day

For the past few weeks, markets have been buzzing with news and rumors surrounding today’s OPEC meeting in Vienna where members will discuss increasing production. To recap, Russia (non-OPEC producer) and Saudi Arabia are in favor of boosting supply by 1 MMbpd. However, other member countries including Iran, Iraq and Venezuela are opposed to the suggested increase.

Yesterday, Iran’s Oil Minister Bijan Zangeaneh suggested an agreement may not be reached within the organization. But after a meeting with Saudi Arabia’s delegate this morning, Zanganeh has reversed his previous stance and has seemed more confidant a compromise would be reached.

Recent headlines are reporting OPEC has agreed to increase production by the suggested 1 MMbpd on paper, but actual output would likely be around 600,000 bpd as some participating members are unable to increase production. The market is anticipating an official OPEC announcement to confirm (or contradict) the recent headlines.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.