Week in Review

Crude prices have been steadily rising this week, even as fuel prices have been heading lower. The market is steadily growing more apprehensive of Saudi Arabia’s intention to increase oil production. OPEC is set to discuss the output hike next Friday, so markets are waiting for clearer direction. Yesterday, the Saudi Energy Minister noted that a change in output quotas is “inevitable” given shortages in Venezuela and Iran. That revelation has helped send crude prices lower this morning, but markets remain unsure of where to go from here.

Federal Reserve Raises Interest Rates

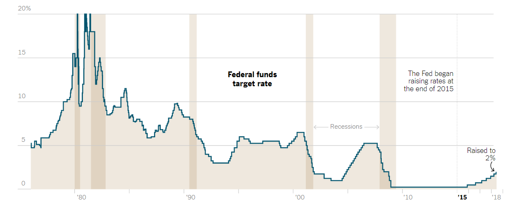

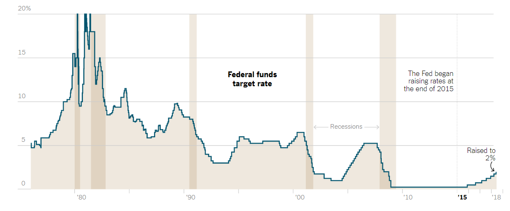

The Federal Reserve increased interest rates by a quarter percent this week, bringing target rates to 1.75% to 2%, the highest level since 2008. The Fed also indicated at least two more hikes will be coming out before the end of 2018. We’ve spent a lot of time recently talking about OPEC and other oil supply/demand trends, so today we’ll quickly examine why interest rates matter to the economy and to oil prices.

Interest rates are a lever used by the Fed to keep the economy running smoothly. During recessions, they lower interest rates to make it easier to borrow money – more borrowed money means more money flowing through the economy. As the economy strengthens, they increase interest rates to keep inflation in check. Looking at the chart below, courtesy of the NY Times, the near 0% interest rates from 2009-2015 was unprecedented in US economic history, so it will take a lot of rate increases to return to a historically “normal” level, around 5%.

Source: New York Times

Interest rate increases cause a strengthening of the dollar – higher interest rates in the U.S. mean American bonds have higher returns relative to other countries, so investors rush to buy U.S. dollars so they can buy American bonds. The dollar and commodities such as crude are inversely correlated – as investors put their dollars into bonds, there are fewer dollars remaining to spend on oil contracts, weakening trading demand and causing prices to fall. Thus, this week’s interest rate hike has created headwinds for oil prices, making crude’s weekly gains that much more surprising.

Additionally, as we noted above, interest rates are used as the economy grows to dampen its growth, smoothing out both the peak and the trough of the business cycle. Thus, higher interest rates will moderate the economy somewhat over the next few months, which in turn will reduce overall oil consumption for the U.S.

Weekly Price Review

Oil prices began the week at $65.56, after being punished in the previous weeks amid OPEC production rumors. This week, the fear of an OPEC production increase weakened as more concrete production losses in Venezuela made the potential gains seem necessary just to keep markets balanced. Oil prices rose steadily throughout the week, with big gains on Wednesday as the EIA reported large oil inventory draws. This morning, WTI crude opened at $67.00, a gain of $1.44 (2.2%) for the week.

While crude prices were steadily rising, fuel prices fell. Diesel opened the week at $2.1637, above the previous week’s lows but below the $2.20 levels experienced in May. The EIA’s inventory report of a large diesel draw helped propel prices higher Wednesday, but by Thursday those gains had been erased. Diesel prices opened at $2.16 this morning and have been falling steadily lower, setting markets up for another week of losses.

Gasoline experienced even steeper losses than diesel. Prices began the week at $2.1125, fell lower on Monday and Tuesday, then gained a whopping four cents on Wednesday. Like diesel prices though, gasoline saw steep losses on Thursday. This morning, prices opened at $2.0934, nearly two cents below their opening prices and continue to fall lower.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.