Rig Counts Data Suggest Future Production Constraints

Oil prices have been a bit slow over the past few trading sessions, with Friday seeing prices dip lower. Today, prices are up again, but not by a large amount. WTI Crude prices are currently $71.60, trading higher by 32 cents.

Fuel prices trended slightly lower Friday, with diesel prices giving up 1.5 cents while gas prices fell a penny. Today, both products are continuing to reverse their gains from last week. Diesel prices are trading at $2.2625, a loss of 0.3 cents. Gasoline prices are flat with Friday’s close, trading at $2.2336.

Oil markets may receive some upward momentum from news that the U.S. and China have put their trade spats “on hold” as they work towards a broader trade agreement. Just a few weeks ago, the two countries were in a pattern of escalating threats of trade barriers. Markets worried that a trade war between the world’s two largest economies would put a significant dent in global economic growth. For oil traders, lower economic growth means less demand for oil and lower prices. This week’s news suggests trade could continue uninhibited, keeping oil demand (and prices) higher.

Oil Prices Drive Rig Counts Higher, Creating Bottlenecks

U.S. oil rig counts remained flat last week at 844 rigs, ending a steady 6-week streak of rising rig counts. Of course, one week of flat rigs does not indicate the end of a trend. Rig counts have been rising quickly over the past year.

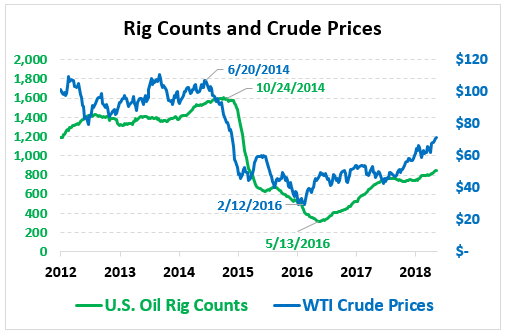

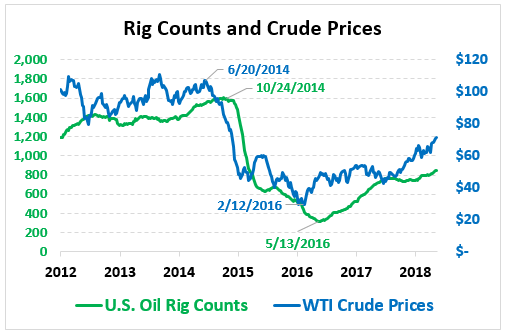

Rig counts have been steadily climbing since 2016, when prices finally halted their massive decline from $100/bbl down to just $30/bbl. Since then, prices have climbed up to their current position of $70/bbl, dragging rig counts with them.

Certainly there’s a strong correlation between prices and rig counts. We’ve noted before that America has become the “swing producer” for the world, increasing production when prices rise and cutting off supply when prices fall. Historically, Saudi Arabia held this position, and could control markets based on their preference for price. Now, market forces have far more control over prices. Prices incentivize production, and as production comes online it tempers the upward price movement.

Rig counts typically follow oil prices at a slight delay – it takes time to get rigs deployed into the field, and it also takes time to shut down a rig. In addition, producers must determine whether the change in prices is a new trend or simply a temporary price swing. In general, it takes about 3-4 months for rig counts to catch up to prices – note the chart below showing a delay between the peak and troughs of rig counts and prices.

As you can see in the above chart, rig counts have been growing rapidly in response to higher prices. Still, rig counts are nowhere near as high as they were in 2012-2014 when prices were $100/bbl. Why the major change?

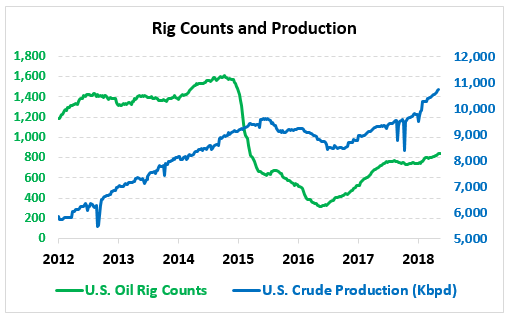

Of course, rig counts are not the same as production. While rig counts fell 80%, from over 1,600 rigs in 2014 to just 320 in 2016, crude production during that time fell just 12%. Drilling rigs are used to drill new wells and create new production – existing wells are not impacted by rig counts. Wells naturally become less productive over time, so without new wells coming online, production declines.

So while U.S. crude production is at all-time highs, rig counts are far below their peak. Does this mean that rig counts will continue to rise and create huge upside for U.S. producers?

In the short-term, rig counts are unlikely to approach their 2014 highs. The recent growth in rig deployment has been limited to the Permian Basin, located in West Texas. Permian rig counts have grown from one-third of total U.S. oil rigs to over half, thanks to advantageous drilling economics in the region. But that huge increase in output has created bottlenecks in the supply chain.

So much oil is being produced in the Permian, there aren’t enough pipelines to move the crude, leading oil prices at the well to be roughly $15/bbl lower than actual WTI crude prices. While WTI prices are currently above $70, many producers are only making $55/bbl because they can’t get their crude to the market. That’s forcing producers to send crude by truck or by rail, which are more expensive options that eat into profits. This constraint will likely continue in the short-term, though pipelines between West Texas and export markets have been planned for the medium- to long-term.

In addition, there’s a labor shortage in West Texas currently – simply not enough rig crews to keep up with rising production. Each rig must be operated by skilled technicians trained to work on the dangerous drilling machinery. When the industry’s boom turned to bust in 2015, many of those technicians were forced to find work elsewhere, and those workers are skeptical of moving back to such a volatile industry. In addition, a national driver shortage puts constraints on hauling the drilling materials to and from drilling sites.

In general, these bottlenecks will put an upper limit on rig count growth, all else being equal. Of course, if oil prices unexpectedly soared to, say, $120/bbl overnight due to a surprise supply outage, producers in the area would likely fast-track projects to increase rig growth as fast as possible – paying much higher wages to crews, pushing new pipeline projects, and paying the additional costs to move excess production to the market. But even with astronomical price incentives, producers would struggle to keep up. Already, drilling costs have risen as labor costs and drilling sands have come into high demand.

On the flip side, if prices suddenly collapsed to $40/bbl once again, rig counts would very quickly decline. The oil industry “bust” in 2015-2016 shows that rig counts will quickly die down as prices fall. If drilling is unprofitable, oil producers will be quick to shut off the tap once again. As rig counts fell, it would once again push laborers to other markets, making it harder in the future to attract workers to such a volatile industry.

Absent a major market-mover causing crude prices to soar to $120/bbl or plummet to $30/bbl, expect steady gains in rig counts, which will push up demand for rig crews and truck drivers in West Texas. If oil prices remain high, rig count growth could expand beyond the Permian into other production areas like the Bakken in North Dakota or in Eagle Ford in South Texas. The Permian currently has the best drilling economics so it’s been the source of most production growth, but labor and pipeline capacity restraints could eventually lead other areas to become more financially attractive. And as prices continue to work their way higher, it’s quite possible that $80/bbl WTI crude could eventually make nearly all oil plays in the U.S. financially attractive, which would send national rig counts soaring.

Regardless of how rig counts perform, production will likely continue from existing wells. Once drilled, wells have very low breakeven points, so prices would have to decline precipitously before wells are shut off. As more pipelines come online to get produced crude into the global market, expect the spread between prices at the well and WTI crude oil (currently a $15 spread) to shrink, increasing the incentive for producers to drill new wells and increase production.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.