Week in Review

As has been the case for the past few weeks, volatility was rampant in oil markets this past week. While crude markets gained roughly a dollar for the week, fuel prices soared as summer driving season gets off to its start. Crude markets tend to follow the news a bit more impulsively than fuel prices, which are more grounded in supply and demand. Oil prices spiked last week following Trump’s announcement on the Iran nuclear deal, and this week fuel prices have been catching up.

Summer driving season is typically very responsive to fuel prices – when prices rise, consumers find ways to avoid extra trips. But according to a survey by NACS, prices won’t be a deterrent this summer despite rising 15 cents compared to last month. Optimistic outlooks on the economy and employment seem to be important factors, with 60% saying they are optimistic the economy will remain strong.

Oil prices continue to receive support from the various market risks currently at play. While Iran is the most prominent issue, on-going concerns over Venezuelan production must also be considered. While the U.S. will likely take sanctions on Venezuelan crude off the table this week, there’s still a possibility of restricting exports of diluents (products used by Venezuela to allow their thick crude oil to flow more freely). The effect would be lower supply.

Given all the big threats to production, it’s been a while since markets have focused on less stable production regions like Nigeria or Libya. Those countries struggled without output in 2017, and could easily see temporary losses in their production. If any such disruptions occurred, consumers would certainly see even higher brief spikes in their fuel prices.

Price Review

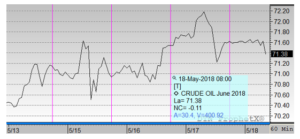

Crude prices increased by $1.06 (1.5%) this week, rising from $70.54 on Monday morning to opening at $71.60 this morning. This week’s price activity was just enough to recoup last week’s highs, which were eroded late last week.

The interesting dynamic in crude markets this week was the spread between Brent (international) crude and WTI (U.S.) crude. Brent crude’s premium stretched to more than $7/bbl above WTI prices, well above the normal $4-$5 range. There’s no substantial difference in quality between the two blends – the price difference is mainly related to supply and demand.

Internationally, there isn’t enough crude oil to meet rising demand, especially with Iranian production expected to fall off the market. While U.S. production is growing rapidly, the infrastructure simply isn’t there to export enough into the global market. In fact, just getting the crude from its production region to domestic markets has been a struggle – crude oil at its production source in West Texas is trading $15 below WTI crude in Cushing TX, simply because of pipeline limitations to get the crude to market. While America has sufficient crude oil (thus keeping American WTI prices somewhat lower), international customers are worried about future oil supplies.

Does that mean WTI prices will stay lower? Don’t count on it. A $7 premium for Brent oil means American producers can earn an additional $7 by exporting internationally – a strong incentive to invest in exporting infrastructure. While the U.S. is enjoying a price discount for now, that discount will eventually be eroded, and WTI prices will catch up to Brent crude oil.

Fuel prices exploded this week, far surpassing crude’s gains. Diesel prices picked up 2.9% this week, nearly double crude’s gains on a percentage basis. Diesel prices opened the week at 2.2222, and opened this morning at $2.2870, a gain of 6.5 cents.

Diesel inventories have been plummeting in recent weeks, though this week saw just a mild inventory draw. Still, demand has been strong this year and analysts expect it to remain strong, thanks to robust economic growth. As more crude oil gets diverted to meet summer gasoline demands, diesel supplies will come under pressure, keeping prices elevated.

Gasoline saw a huge 3.8 million barrel inventory draw this week, which caused prices to soar on Wednesday. Prices opened the week at $2.1852, and opened this morning at $2.2489, a gain 6.4 cents or 2.9%. Refinery utilization has risen to 91.1% which should help gasoline stocks normalized, but summer demand should keep downward pressure on stocks. As noted above, consumers show no sign of slowing down their summer driving season, so expect more summer inventory declines and supported prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.