Quiet Markets following EIA Report

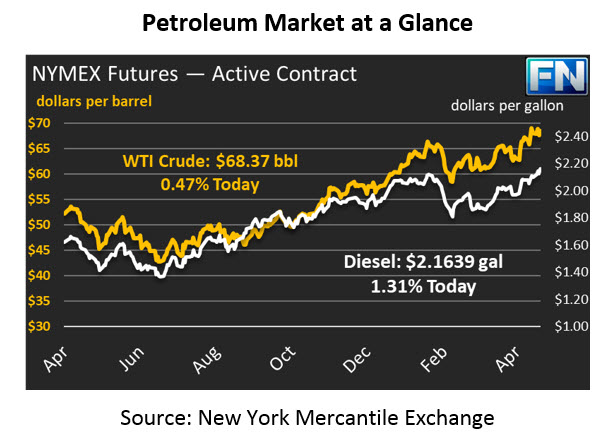

Prices are tiptoeing higher this morning, following small price increases yesterday. As May 12, the deadline for Trump to extend Iran sanction waivers, approaches, markets are growing anxious and fearful of higher prices. Currently, crude prices are $68.37, up 32 cents since yesterday.

After mixes trading results yesterday, both refined fuel products are trending higher this morning. Gasoline was set back by EIA reports of gasoline inventory builds, while the continuous downward pressure on diesel stocks sent prices almost a penny higher. This morning, diesel prices are sustaining their upward momentum, with prices up 2.8 cents at $2.1639. Gasoline prices have reversed their downfall, trading up by just 0.8 cents to trade at $2.0973.

EIA Data

The EIA reported their weekly inventory data yesterday morning. Crude inventories rose, though markets had already priced in the build on Tuesday following the API’s report. Gasoline stocks also rose, causing prices to fall despite overall oil prices trading higher. Diesel inventories continued their descent, giving prices a boost.

Across the board, demand of many fuel products fell over this past week. Last week, we noted that gasoline demand had achieved all-time record highs – in April, before summer driving season hits full-stride. The implications were extremely high gasoline demand at a time when inventories are trending generally lower. This week, gasoline demand fell 774 kbpd to 9.08 MMbpd. That’s still above the five-year average demand, but far lower than last week’s reported level. Diesel and jet fuel demand also weakened, helping to prevent any big run-up in prices this week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.