Week in Review

After weeks of stagnation and muted prices, oil prices soared this week, hitting new three-year highs on Wednesday and Thursday. Markets have been weighted recently by concerns over trade barriers between the U.S. and China. This week, those fears have given way to concerns over Middle Eastern politics.

Two major concerns are on-going in the Middle East. First is the ramping of missile launches from Houthi rebels in Yemen against Saudi Arabia. The conflict has become a proxy for Saudi-Iran tension, since the Houthis are aligned with Iran. Because both Saudi Arabia and Iran are major oil producers, any conflict between those two countries could cause prices to skyrocket.

In addition to Saudi Arabia and Iran, Trump’s threat of military intervention in Syria is also destabilizing oil markets. While Syria is not a major producer, military acts in Syria would be blocked by Russia. Such open opposition by Russia could cause the U.S. to impose trade sanctions that would prevent the purchase of Russian oil, causing chaos for markets.

Price Review

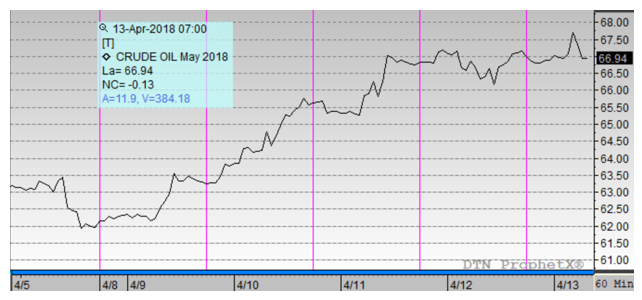

Crude prices have soared this week, opening the week at $62/bbl and opening this morning at $67.18, a huge 8.4% price increase this week. Although the EIA’s inventory data showed a small build, markets could not take their focus off the Middle East, where rumors of war are rampant. Prices rose the first four days of the week, and may revert to gains again later today.

Fuel prices also rose quickly, with diesel picking up 6.5% this week. Beginning the week at $1.95, prices today opened at $2.0846, nearly 15 cents higher. Prices are taking a breather this morning, down over a penny from yesterday’s close. Regardless of today’s losses, diesel is set to end the week much higher.

Gasoline was no exception to the large hike in prices this week, gaining 5.8%. Gasoline opened at $1.9525 Monday morning and $2.0598 this morning, gaining over 10 cents throughout the week. Like diesel, prices have taken a small dip this morning after a week of trading higher, but will still end the week in a three-year-high price territory.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.