The U.S. Dollar and Oil Inventories Decline

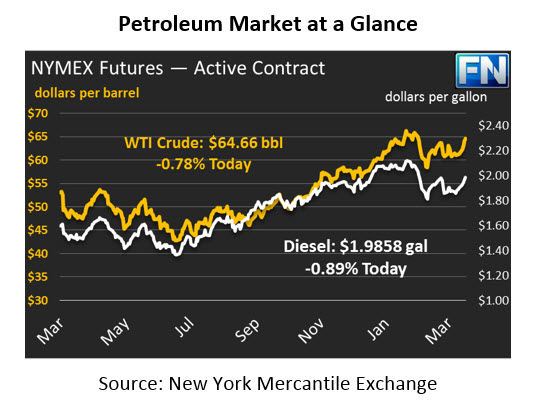

Oil prices continued their upward trend yesterday supported by a surprise draw in crude oil reported by the EIA and a falling dollar. Oil prices gained another $1.45 to close the day above $65/bbl for the first time since early February. Crude prices have lost some steam this morning, down by 51 cents to $64.66. Losses this morning are tied to profit-taking in the market after 2 days of heavy gains.

Refined fuels saw huge positive price activity yesterday, with diesel gaining 4.87 cents (2%) and gasoline gaining 3.9 cents (1.9%). Both products closed the day over the $2 mark. Today, both prices have lost some traction due to the current profit-taking activity. Diesel prices are currently down 1.79 (.89%) cents, at $1.9858. Gasoline prices are down by a similar margin, losing 1.64 (.82%) cents to trade at $1.9958.

Inventories Decline

Prices continued to rally after yesterday’s EIA inventory report. The oil complex drew across the board. Refinery run rates are up to 91.7% as despite the maintenance turn-around season. Imports decreased by around half a million barrels per day, while exports increased, helping to draw down inventory levels.

The crude inventory draw came mainly in the Gulf Coast which drew by 3.6MMbbls. Gulf Coast refinery run rates are at 92.6% capacity in, up over 2% from the past 2 years. The EIA report was mostly in line with Tuesday’s API report. Diesel drew for the sixth consecutive week, with storage levels down in every region excluding the Gulf Coast. Gasoline supplies also fell as the winter grade purge continues.

The U.S Dollar Declines

The Federal Reserve raised short-term interest rates by 25 basis points on Wednesday, sending the U.S. dollar lower, lending strength to oil prices. Commodities and the dollar generally have an inverse relationship. As the value of the dollar weakens, commodities become less expensive for foreign buyers to purchase, increasing demand and sending prices higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.