Natural Gas News – February 13, 2018

Natural Gas News – February 13, 2018

Key The US Will Become a Net Energy Exporter by 2022

Economics Gazette reported: The US will become a net energy exporter by 2022, according to the EIA’s annual forecast. According to the institution’s assessment, the sector will be characterized by a strong increase in energy resource extraction, but against the backdrop of domestic demand will remain without major changes. The US Energy Estimates forecast for 2050 is that average consumption growth will be at 0.4% per year. At the same time, the gross domestic product (GDP) growth will be between 1.7% and 2.6% per year. The administration also said that gas and oil extraction would continue to grow. After 2022, most power plants in the country will use natural gas or renewable energy sources. This is the result of the low cost of natural gas and the cheaper technologies for RES installations. The forecast also includes the expectation of a Brent oil price by 2050. The highest value would be 229 USD per barrel, and the lowest would be 52 USD per barrel. In the realistic scenario, the price of oil will be 114 USD per barrel by 2050. For more on this story visit economicsgazette.com or click http://bit.ly/2nUTa1I

NYMEX March Natural Gas Down 2.3 Cents Seeking Direction

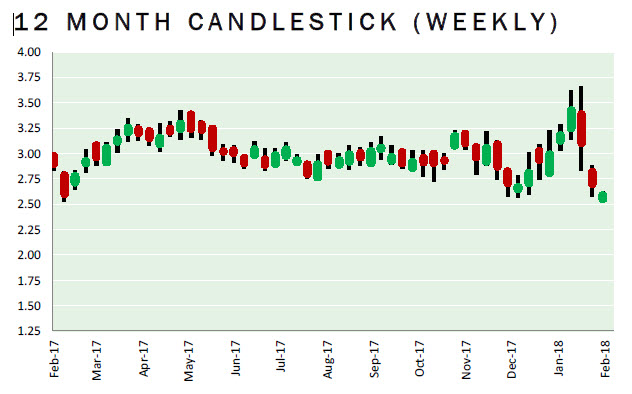

Platts reported: After settling 11.3 cents lower at $2.584/MMBtu Friday, NYMEX March natural gas futures were near unchanged overnight ahead of Monday’s open with changing fundamentals. At 7:15 am ET (1215 GMT) the contract was 2.3 cents lower at $2.561/MMBtu, while trading a range from $2.545/MMBtu to $2.607/MMBtu. Colder weather helped drive up natural gas demand to start February, with the EIA’s latest “Natural Gas Weekly Update” showing a 13% rise in total US gas consumption during the week to Feb. 7 from a week earlier, led by a 20% gain in ResComm demand. For more on this story visit platts.com or click http://bit.ly/2o3O1U3

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.