Natural Gas News – January 15, 2018

Natural Gas News – January 15, 2018

Hedging Helps Ensure Surging Appalachia Natural Gas Production

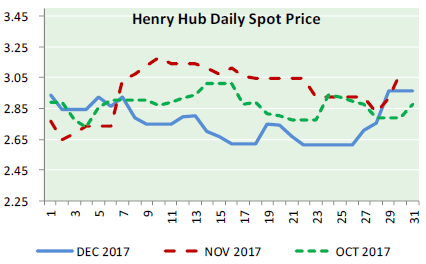

Forbes reported: Natural gas prices have been trapped in the historically low winter range of $2.60 to $3.10 per MMBtu for prompt month contract for many weeks now. The past week, however, February contract was up 13%, to close at $3.20 on Friday. Although the recent Polar Vortex 2.0 dropped national output to 71 Bcf/d due to some well freeze offs, we saw record numbers of 77-78 Bcf/d in the previous weeks. According to the U.S. Department of Energy here, production in 2017 averaged about 74 Bcf/d but is expected to average 80-81 Bcf/d this year and 83-84 Bcf/d in 2019. This non-stop surge in U.S. gas production is hugely impressive: in its most recently projection on January 9, the DOE forecast Henry Hub gas prices to actually fall this year to $2.88, compared to $2.99 in 2017, and rising to just $2.92 in 2018. Remember: lower prices make it harder, not easier, to produce, yet 2018 is expected to see the largest output growth in our history. One of the reasons current prices don’t impact output as much as some Americans might think is because producers often hedge future production. For more on this story visit forbes.com or click http://bit.ly/2mGTKze

The Most Remarkable Natural Gas Deal of 2018

Oilprice.com reported: The potential first delivery of Russian LNG to U.S. shores is ruffling some feathers, due to sanctions in place on Novatek, one of the partners in the Yamal LNG terminal – the apparent origin of the LNG heading to the Everett LNG terminal in Boston. The Yamal LNG terminal in Northern Russia is one of the biggest LNG projects in the world. Once running at full tilt, it will supply 16.5 million tons of LNG to the global market annually – heading predominantly to Asian and European markets. While sanctions may still be in place with certain Russian entities, the U.S. is a regular recipient of Russian oil and products. For more visit oilprice.com or click http://bit.ly/2DbQ1nH

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.