Short-Term Energy Outlook: Crude Oil

Prices: The front-month futures price for North Sea Brent crude oil settled at $62.20 per barrel (b) on December 7, 2017, an increase of $1.71/b since November 1. Front-month futures prices for West Texas Intermediate (WTI) crude oil for delivery at Cushing, Oklahoma, increased by $2.39/b over the same period, settling at $56.69/b on December 7 (Figure 1). November Brent and WTI monthly average spot prices were $5.20/b and $5.06/b higher, respectively, than the October average spot prices.

Crude oil prices traded at the highest levels in more than two years in November and early December 2017. On November 30, the Organization of the Petroleum Exporting Countries (OPEC) announced an extension of the crude oil supply reduction agreement through the end of 2018, which was broadly in line with market expectations in the days leading up to the meeting. The non-OPEC countries that agreed to crude oil production cuts in 2017 also agreed to continue limiting output through the end of 2018. Saudi Arabia and Russia will co-chair a monitoring committee designed to assess the group’s adherence to the production targets. The group plans to review production levels at the June 2018 meeting depending on market conditions at that time. EIA estimates OPEC crude oil production averaged 32.5 million barrels per day (b/d) in 2017, a 0.2 million b/d decrease from 2016 levels, and EIA forecasts OPEC crude oil production will average 32.7 million b/d in 2018.

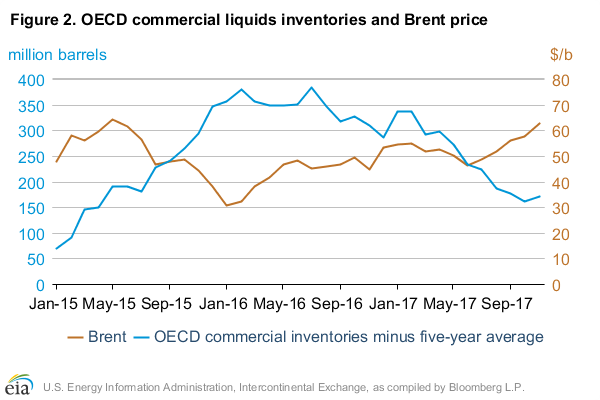

An important metric for identifying oil market balance is the level of commercial liquids inventories compared with their five-year average for countries in the Organization for Economic Cooperation and Development (OECD). Since reaching a record high of almost 3.09 billion barrels at the end of July 2016, total OECD liquid fuels inventories have fallen by 137 million barrels to 2.95 billion barrels at the end of November 2017. Over the same period, the surplus to the five-year average has declined by 210 million barrels, ending November at an estimated 174 million barrels (Figure 2). Going forward, the five-year average will include a higher proportion of data points from 2015-17, which were years of high inventory levels, resulting in higher five-year average stock levels for comparison. The OECD five-year average inventory level for May 2018, the last full month before the June 2018 OPEC meeting, will be 2.8 billion barrels, 80 million barrels higher than the five-year average for December 2017. Although EIA forecasts OECD inventories to increase by 51 million barrels from December 2017 through May 2018, the level of OECD inventories relative to the five-year average is expected to decrease by 29 million barrels because of the increase in the five-year average.

Despite the extension of the OPEC agreement, EIA forecasts higher output from non-OPEC countries to contribute to growth in total liquid fuels supply in 2018. The non-OPEC outlook is 0.1 million b/d higher than EIA’s November STEO, averaging 60.3 million b/d in 2018, which would be 1.7 million b/d higher than 2017 levels. This growth, together with the forecast 0.3 million b/d growth in OPEC crude oil production and another 0.1 million b/d increase in OPEC non-crude liquids production, results in forecast total global liquids production growth of 2.0 million b/d in 2018. EIA expects that crude oil price increases in late 2017 will contribute to U.S. crude oil production growing to more than 10 million b/d by mid-2018. Overall, U.S. crude oil production is forecast to increase by an average of 0.8 million b/d in 2018. Canada, Brazil, Norway, the United Kingdom, and Kazakhstan are forecast to add a combined 0.7 million b/d of liquids production in 2018.

Despite higher oil prices, EIA expects global liquid fuels demand to increase by more than 1.6 million b/d in 2018, up from growth of 1.4 million b/d in 2017. Demand growth is not forecast to keep pace with supply growth, however, resulting in global liquids inventories increasing modestly in 2018. With global inventories expected to increase in 2018, EIA forecasts Brent crude oil prices will decline from current levels to an average of $57/b in 2018, which is $2/b higher than forecast in the November STEO.

In late November 2017, the WTI futures curve reached the same level of backwardation (when near-term prices are higher than longer-dated prices) as the Brent futures curve, based on the 1st-13th month futures price spread. The Brent 1st-13th spread decreased by 34 cents/b from November 1 to settle at $2.39/b on December 7, whereas the WTI 1st-13th spread increased by 33 cents/b over the same period, settling at $1.89/b (Figure 3).

The Keystone Pipeline, which delivers crude oil from Western Canada to the U.S. midcontinent, leaked approximately 5,000 barrels in South Dakota and was temporarily shut down. The pipeline leak reduced flows into Cushing, Oklahoma, (the delivery point for the WTI futures contract) and likely contributed to a $1.01/b daily increase in WTI front-month futures prices relative to longer-dated futures prices on November 21, 2017, the largest daily increase in almost a year. Cushing stocks fellby 2.9 million barrels the week ending November 24, and imports from Canada declined by 0.4 million b/d. The Keystone Pipeline resumed operations on November 28.

Total U.S. crude oil inputs to refineries set an all-time high for the month of November, reflecting the refining sector’s return from hurricane disruptions and maintenance season in the third quarter. Increased refinery demand, in addition to the Keystone Pipeline disruption, contributed to the stock draws from Cushing, Oklahoma, and likely provided upward price pressure on WTI front-month futures prices.

U.S. crude oil imports: The OPEC crude oil production cut agreement and other supply reductions have changed U.S. crude oil import trends in 2017. Saudi Arabia reduced crude oil exports to most regions, including to the United States, as a result of both its voluntary crude oil production cuts and the increase in the amount of crude oil Saudi Arabia refines domestically. Total Saudi Arabian crude oil exports fell to 6.5 million b/d in September 2017, the lowest level since March 2011, according to the Joint Organization Data Initiative (JODI). Motiva Enterprises LLC, which owns the largest refinery in the United States in Port Arthur, Texas, is a wholly-owned refinery subsidiary of Saudi Arabia’s national oil company, Saudi Aramco. Motiva’s imports of Saudi Arabian crude oil decreased significantly in 2017, down to 30% of Motiva’s total crude oil imports in September (Figure 4), compared with 65% on average during 2016. Overall, total U.S. crude oil imports from Saudi Arabiafell to the lowest level in 30 years, with some of that decline made up by increased imports from Iraq.

Venezuela’s crude oil production has declined since 2016 because of operational and financial difficulties. EIA estimates Venezuelan crude oil production averaged 1.9 million b/d in November 2017, down from 2.4 million b/d as recently as December 2015. Reduced production has lowered the available amount of Venezuelan crude oil for export, with some cargoes being diverted away from the United States to other countries to repay oil-for-loan agreements. Citgo Petroleum Corporation is a wholly-owned refinery subsidiary of Venezuela’s national oil company, Petroleos de Venezuela SA (PDVSA), and owns refineries on the U.S. Gulf Coast. Between 2015 and April 2017, Citgo Petroleum had been generally increasing its share of crude oil imported from Venezuela, from 59% in January 2015 to more than 85% in April 2017. Since then, the share of crude oil Citgo imports from Venezuela fell to a three-year low in August 2017 before rising slightly in September. In September, total U.S. imports of Venezuelan crude oil fell to the lowest point since 2003. In November, major credit rating agencies declared both Venezuela and PDVSA to be in varying levels of default because of late interest payments. Any increased financial difficulties could exacerbate Venezuelan crude oil production and export declines, ultimately removing its crude oil from the global market.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.