Today’s Market Trend

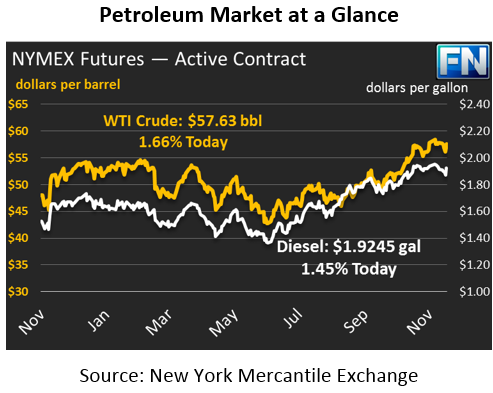

Oil prices move higher this morning after Nigeria’s announcement yesterday that there could be a strike by the key oil workers union. Crude recovered some of its strength during yesterday’s session, closing 69 cents above the opening price. Prices have continued to strengthen this morning, gaining 94 cents (1.66%) to trade at $57.63.

Refined product markets are following crude higher, with Diesel leading the way. Prices gained over 3 cents yesterday after experiencing some heavy mid-week losses. Diesel prices are trading at $1.9245 this morning, a gain of 2.75 cents (1.45%), putting diesel back in line with this week’s opening price.

After the EIA report showed large inventory builds for gasoline, prices crashed on Wednesday to reach an 8-week low closing price. Although, like diesel, gasoline also had large gains yesterday, closing 3.33 cents higher than its opening price. Gasoline continued its recovery this morning gaining a little over 2 cents (1.21%) to trade at $1.7206.

Nigeria announced the potential of a strike on the part of PENGASSAN (Petroleum and Natural Gas Senior Staff Association). PENGASSAN is the second largest union in Nigeria for oil and natural gas professionals. The union is threatening to strike due to upper management implementing heavy lay-offs. Several hundred employees have been let-go and the union has petitioned for an intervention by the Nigerian government. If no intervention is made, the country will face a nationwide strike, potentially cutting the OPEC countries oil production and output.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.