Today’s Market Trend

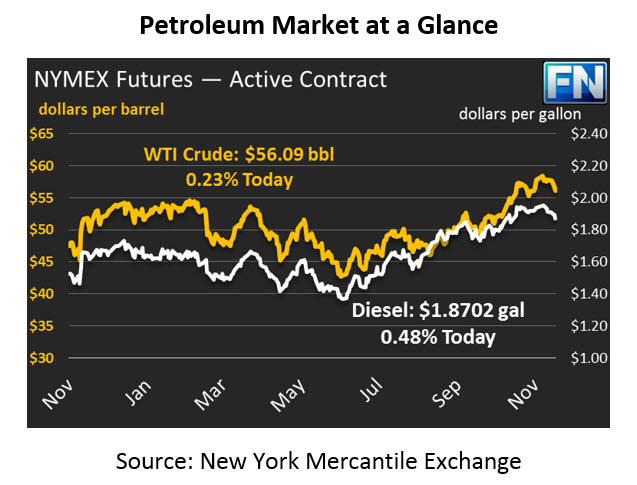

The oil complex posted heavy losses across the board after yesterday’s EIA report revealed sharp increases in refined product stocks and high refinery utilization rates. Crude prices gave up $1.49 to close at $55.96, its lowest closing price in 3 weeks. Prices gained a mere 13 cents this morning and are currently trading at $56.09. WTI crude fell by $1.66 to reach $55.96 after yesterday’s bearish report. Brent also lost $1.64, bringing prices to close at $61.22, and keeping the spread between WTI and Brent a little over $5.

Gasoline prices took a big hit yesterday, shedding nearly 4 cents as the EIA supported the API data that showed a large build in gasoline inventories. After fluctuating lower and higher this morning, gasoline prices are now back up by 1.46 cents, trading at $1.6755, half a cent above yesterday’s close.

Diesel prices also fell with great force during yesterday’s session. Diesel gave up almost 5 cents to close at a 4-week low of $1.8613. Diesel prices are slightly higher this morning, trading up just 89 points at $1.8702.

The EIA released their weekly data yesterday, which came relatively in line with Tuesday’s API report although slightly more constructive. The EIA showed a crude stock draw of 5.6 MMbbls, bringing U.S. crude inventories to their lowest level since October 2015. The report also showed that overall refinery utilization rose by 1.2% and production increased by 25kbpd to reach 9.71MMbpd for the first time since April 1971.

On the product side, gasoline stocks surged by 6.8MMbbls, while diesel inventories rose by 1.7MMbbls. Although the stock builds did not quite meet API’s predictions, the build in gasoline was more than 3x what the market expected (6.8 actual vs. 1.7 expectation). The large product build of 8.5 MMbbls combined with high refinery rates and increased production sent prices on a downward spiral during yesterday’s trading session.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.