FN360° Exclusive: Fundamentals Point to Higher Prices

Source: FUELSNews Editorial Team

Note: The FN360°, delayed by the extreme supply conditions during Hurricanes Harvey and Irma, will be released soon. We’re excited to provide you a summary of market conditions during Q3:

- How Harvey & Irma disrupted the fuel supply chain

- Why prices in the Northeast have been so low relative to national trends

- What supply & demand will look like in 2018

Inventories

Inventories in Q3 were strong drivers of fuel prices, with good reason. After trending even higher than 2016’s historically high inventory levels, crude stocks finally dipped below 2016 levels in July, continuing the trend downwards through August before briefly popping up again thanks to Hurricane Harvey shutting in refineries and ports, trapping crude oil in storage.

Inventories began the quarter at 495 million barrels (MMbbls), just 5 million barrels above 2016 levels but a staggering 130 MMbbls above 2012-2015 averages. Crude inventories bottomed out on August 25 at 459 MMbbls, an impressive 36 MMbbl draw in just 8 weeks (-7.2% change, an average of 4.5 MMbbls drawn each week). The declines did not last, however, and stocks added 15 MMbbls in just three weeks after Hurricane Harvey. Since then, the trend has been back downwards, driven by strong U.S. crude exports.

While Harvey drove crude inventories higher, gasoline stocks fared differently. For most of the year, gasoline has remained about 25 million barrels above the 2012-2015 average; in September, they fell below 2015 levels, reaching their lowest level in years. Without refineries online to add gasoline to fueling transport systems, suppliers were forced to rely on gasoline in storage, causing prices to skyrocket during and immediately following Hurricane Harvey.

Gasoline inventories began the quarter at 236 MMbbls, falling as low as 216 MMbbls (a 20 MMbbl drop, of 8.5%) in late September. Inventories did add over 2 MMbbls back in the last weeks of September, as refineries came back online and gasoline demand fell off due to demand destruction.

Diesel had its own unique path following Harvey. Unlike gasoline stocks, diesel stocks continued their draws unabated, with five straight weeks of draws to end the quarter. Diesel inventories began the quarter at 137 MMbbls, and ended the quarter at a low-point of 117 MMbbls, which like gasoline, was a 20 MMbbl draw, but was double the size of gasoline’s draws on a percentage basis (14.6% vs. 8.5%).

One fascinating trend in Q3, 2017, was that diesel inventories actually ended lower than they began. Diesel inventories typically rise throughout the year before seeing steep losses in the autumn and winter. Autumn demand is driven by agricultural demand, and is particularly acute in the Midwest. Heating oil, used to heat homes in northern states, is a demand driver during the winter, causing diesel stocks to continue falling. This year, inventories are already lower heading into the fall; markets are expecting more steep draws for the next several months, which could put inventories directly in line with historical levels.

Exports

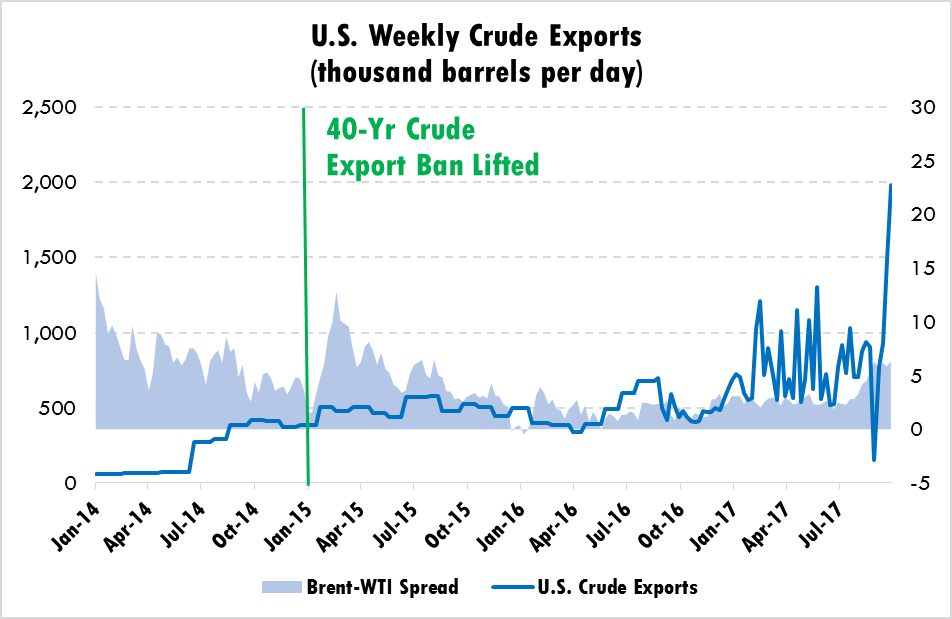

In Q3, U.S. exports exploded, driven by rising Brent-WTI spreads. WTI crude oil is made in America, while Brent crude is considered the international price of crude oil. The difference between those two oil indexes drives imports and exports for the U.S. In 2014/15, the spread reached as high as $13/barrels; however, producers could not capitalize on higher international prices because of a ban on exports. Until December 2015, crude exports could only travel to Canada.

Even after the ban was lifted in December 2015, exports remained weak for years, as export infrastructure took time to be created – pipelines aren’t built overnight. Since January 2017, exports have been increasing, rising above 1 million barrels per day on several occasions. Exports remained suppressed, however, by narrow Brent-WTI spreads. When exporting internationally, barges cost roughly $4 per barrel of crude, meaning that Brent-WTI spreads must increase beyond $4/bbl to incentivize strong exports.

That opportunity came following Hurricane Harvey, when U.S. crude prices fell amid declining refinery run rates. Brent prices soared during that period, boosted by strong demand for refined products in the U.S. Brent-WTI spreads surpassed $5, and kept soaring as high as $7. The spread ended the quarter at $6, accompanying a record high level of exports – just shy of 2 million barrels per day.

Production

Crude oil production in the U.S. has risen to be just shy of record production levels set in June 2015, just before the bottom fell out of the market and prices collapsed. The highest weekly reading of U.S. crude production was set at 9,610 thousand barrels per day (kbpd); the last posted level in September 2017 was just 49 kbpd shy of that record level.

U.S. producers are known internationally as swing producers, ramping up production when prices go up and shutting off the tap when prices fall. In Q3, crude prices averaged $48, slightly below the $50 level normally cited as necessary to justify production. However, prices in late September surpassed $50, leading to the high production levels seen as the month closed.

Refining Capacity

Refining capacity was significantly impacted in Q3 by Hurricane Harvey. For most of the summer, both refining utilization and overall capacity trended flat, with no major changes in refining infrastructure. Refining capacity decreased modestly in July as a few refineries went offline temporarily, but the overall trend in refining utilization was upwards.

Of course, Hurricane Harvey stopped that in its tracks. Refinery utilization fell from almost 97% down to 80% in one week, bottoming out at 77.7% utilization during the peak of the outage. The outage had global implications – the reduced availability of fuel in the U.S. incentivized supplies from other countries to be sent to the U.S., driving up the prices of fuel slightly in other nations as well. Since oil is a global commodity, losing over 3 million barrels per day of refining capabilities, no matter where it occurs, will cause shockwaves throughout the world.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.