Today’s Market Trend

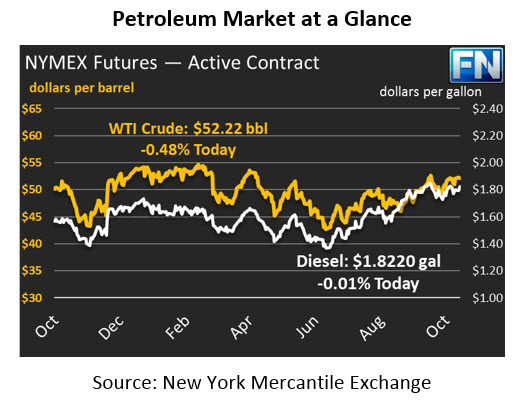

Markets got a strong boost yesterday from a bullish API report, which propelled prices higher yesterday afternoon. Crude oil prices gained 58 cents (+1.1%) yesterday, despite a reported stock build. This morning, prices have slowed a bit, but have still held on to much of their gains. Crude closed the day at $52.47, the highest closing price since April 10. Prices this morning are $52.22, a loss of $.25.

Diesel prices grew even more substantially, picking up 3.5 cents (2.0%) yesterday and far surpassing the $1.80 level we mentioned yesterday. Prices closed at $1.8221 yesterday, and are trading at virtually the same level this morning. Gasoline also had saw prices move higher, with 4.1 cent (2.4%) gains. Prices this morning are continuing to rise higher, with markets up 76 points to $1.7231.

The API’s inventory report supported markets yesterday, with a combined 10.2 million barrel (MMbbl) draw between crude, gasoline, and diesel stocks. Crude saw a surprise build, with a meager .5 MMbbl increase, but the large draws on gasoline and diesel supplies more than offset the build. Last week, the EIA and API data were generally aligned; the week before the two reports were polar opposite. The trade will be watching to see if the EIA confirms the data. If it does, today could once again close at levels not seen in months. If the EIA report is weaker but still bullish, markets could dip down slightly. A polar opposite report like two weeks ago would certainly send prices crashing lower once again.

Markets received support yesterday from Khalid al-Falih, Saudi Arabia’s Energy Minister, who reaffirmed that Saudi Arabia would do whatever it takes to bring inventories back to five-year average levels. Similar statements have come from other countries involved in the production cut, and markets are interpreting them to mean that the OPEC/NOPC deal, which expires in March 2018, could be extended. The energy minister also said that once the deal expires, some level of restraint will be agreed on by countries to ensure prices do not spike once again.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.