Today’s Market Trend

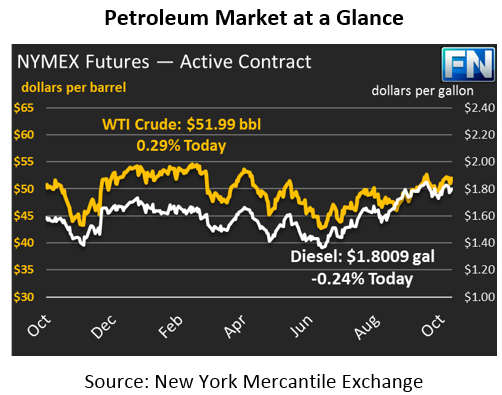

Oil markets are trading flat this morning after seeing mixed pricing results on Friday. Crude oil fell and rose again on Friday, ending the day just 5 cents above their opening price. Today, crude is extending its steady trade, gaining just 15 cents this morning to reach $51.99.

Refined products had a much better day on Friday. Diesel prices gained just under 3 cents (+1.6%), while gasoline gains surpassed three cents (2.0%). Today, both products are trading weaker, trading generally flat to lower. Diesel prices are currently $1.8009, a loss of half a cent, while gasoline prices are down a quarter of a cent to $1.6754.

Over the weekend, OPEC’s monitoring committee announced that deal compliance in September was 120% of the original cuts, which is helping to prop up markets this morning. Compliance has been improving since its early year lows, which has helped set the stage for another grand move from OPEC to extend production cuts (or perhaps even deepen them?) in 2018.

Markets continue to track the situation in Iraq, where instability has caused oil exports from Kurdistan to fall from 600 thousand barrels per day (kbpd) down to just 250 kbpd. However, producers in southern Iraq are boosting production by 200 kbpd to compensate for the shortfalls in the north. While Iraq and the Kurds are struggling to work through separation anxiety, the whole nation is still subject to production limits from the OPEC deal, and the country will surely seek to keep output as close as they can to their cap in order to keep revenues high.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.