Today’s Market Trend

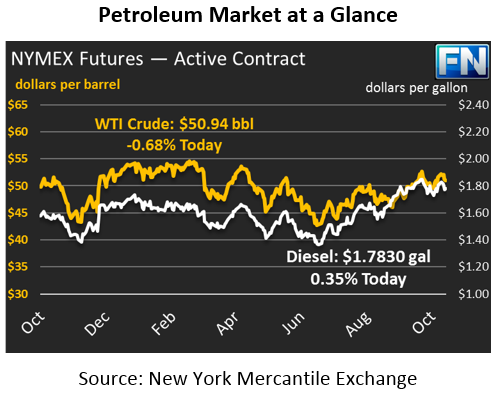

It’s another sleepy Friday for the market, with crude and refined products moving well below 1% in either direction. After some losses yesterday, crude markets are continuing their gentle descent, giving up 35 cents (-.7%) this morning. Crude prices are currently $50.94.

Diesel markets are rising higher this morning, up 63 points (+.35%) to $1.7830. After losing almost three cents yesterday, the small gains appear to be some light buying. In general, refined products have been performing better than crude today. Gasoline is trading flat, avoiding crude oil’s losses this morning. Gasoline prices are $1.6449, basically unchanged from their closing level yesterday.

Chicago diesel fuel buyers are seeing some of the highest local premiums in two years. Basis, the difference between NYMEX prices and wholesale spot prices in the greater Chicago area have risen to 17 cents, the first time they’ve surpassed a dime since 2015, when prices skyrocketed by 37 cents over national NYMEX prices. Strong fall harvest demand is driving demand higher, while ExxonMobil’s refinery in Joliet, Illinois is undergoing planned maintenance. Those factors combined to cause one of the largest Midwest stock draws in years, sending basis soaring. For consumers who have not hedged their basis risk in the area, strap in for some hefty price premiums for diesel fuel compared to other areas.

In renewables markets, Renewable Identification Numbers (RINs) have soared to two month highs after the EPA announced they were backing down on reforms to the Renewable Fuel Standard. The EPA, led by Scott Pruitt, had announced that they were considering cutting the renewable volume obligation lower for 2017, causing renewable markets to shudder. Yesterday, the organization announced that they would not be reducing the volume requirement, adding confidence for renewables suppliers and causing tax credit prices to soar.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.