Today’s Market Trend

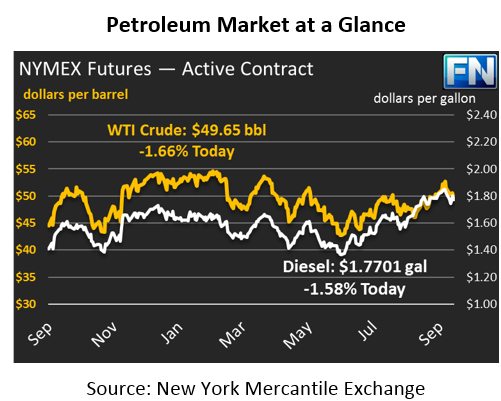

Markets are soaring higher this morning, with the energy complex seeing gains across the board. Crude prices are up $1.05 (2%) this morning, propelled by the EIA’s inventory report and by recent news alerts. Crude prices are well above $51 this morning, at $51.64, nearly a dollar higher than the opening price this morning.

Diesel prices have seen similar gains today, up 2.1% to $1.8034. Diesel prices found additional strength from the EIA’s reversal of bearish API inventory news. Gasoline is up a whopping 4.15 cents (2.6%) this morning to $1.6247, a strong gain despite the EIA’s reported stock build yesterday.

Two factors are driving markets higher this morning, or rather two areas: China and the Middle East. China posted its second highest import numbers ever, importing nearly 9 million barrels per day (MMbpd) in September, significantly above 2017’s average level of 8.5 MMbpd. China is one of the demand centers showing strong growth that has helped keep prices higher; above-average demand from one of the largest fuel consumers in the world is significantly helping prices today.

Instability in the Middle East is also giving markets strength. In Iraq, Kurdish militia are gearing up to keep Iraqi troops out of their oil fields. To rewind a bit – a few weeks ago, the Kurds in the north part of Iraq voted with over 90% agreement for independence from Iraq. Iraq and Turkey both frowned on the idea, and Iraq has sent troops to secure oil fields in the North. Turkey also threatened to turn off the pipeline running from the Kurds’ oil fields to the Mediterranean, since it flows through Turkey (though so far, no action has been taken by Turkey). Now, it appears the Kurds are gearing up to defend the vote. The international community is watching closely to see whether the tension will escalate to actual conflict.

In addition to instability in Iraq, President Trump is expected to announce later today that he is decertifying the Iran nuclear deal. While the president’s actions won’t formally unravel the deal and reimpose sanctions, it does send the issue back to Congress for discussion. Markets collapsed when the international community lifted sanctions on Iran years ago, so the risk of re-imposing them is giving the market jitters.

The EIA released its weekly inventory report yesterday, a day late due to Columbus Day. The report completely contradicted the API’s report, with crude and diesel now showing a stock draw and gasoline showing a stock build. The EIA is the authoritative source of data, so this has once again brought up questions on the accuracy of the API’s data. In general, the EIA’s report was in line with market expectations. While it wasn’t outlandishly supportive for prices, it did give markets a reason to begin reversing Wednesday’s losses, which had been triggered by the API’s data.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.