Today’s Market Trend

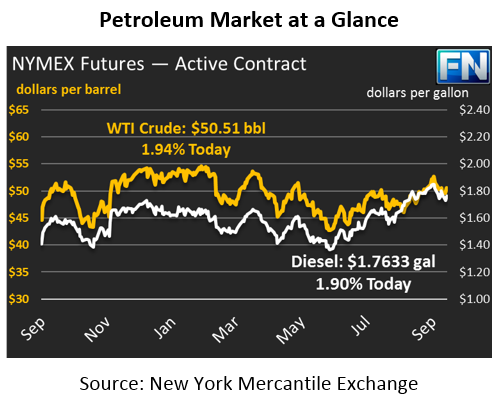

Oil markets are roaring back to life this morning, with oil prices up across the board. Oil prices were flat yesterday, with crude gaining just over a quarter, but prices have received a boost from confidence in OPEC’s talking points on market rebalancing. Prices have pushed above $50/bbl this morning, gaining $.93 (1.9%) since yesterday’s close. Crude prices have been dancing on either side of $50 lately, just high enough to incentivize U.S. production but low enough to keep new production from coming online.

Refined products have had a similar morning, with gasoline and diesel both gaining over 1.5% this morning. Both products also traded flat yesterday, not moving more than 1/5 of a cent. Diesel prices are currently $1.7633, up 2.8 cents (1.6%) from yesterday’s close. Gasoline prices are $1.5901, up more than three cents (2%) above yesterday’s closing price.

Saudi Arabia announced yesterday that they would be reducing crude allocations for their customers by 560 kbpd. Interestingly, Iraq and Iran have both boosted exports to their highest levels since the beginning of the year, offsetting the global supply impact. OPEC’s Secretary General Barkindo urged US producers to cap their production along with the rest of the world, perhaps as a follow-up to his statement on “extraordinary measures” being needed to continue the rebalancing.

Tropical Nate continues to shut in 1.5 million barrels per day (MMbpd) of production in the Gulf of Mexico, down from 1.6 MMbpd reported on Sunday. While operations are expected to restart without issue, the lack of crude supply is impacting markets. Crack spreads (the difference between the price of a barrel of crude and a barrel of gasoline or diesel) are falling, since the storm affected production and not refineries.

Markets are watching for a series of reports this week, including the API and EIA inventory reports (delayed by a day due to Columbus Day), the EIA STEO, the IEA’s monthly report, and OPEC’s monthly oil market report. The results from these updates will drive prices in the latter half of this week, so hold on for a surge of news directing the markets this week.

Fires have been reported in several areas in Northern California, causing concern for many residents. At least 11 people have died and 100 have been treated for fire related injuries; 20,000 residents have been forced to evacuate. So far, the fires have remained to the north of major fueling infrastructure. In the map below, the blue markers represent refineries, the red markers are fuel terminals, and the orange dots indicate approximate locations of reported fires.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.