Nat Gas News – September 27, 2017

Nat Gas News – September 27, 2017

Chesapeake sees 15 percent drop in third-quarter output as Harvey hurts

Reuters reports: Chesapeake Energy Corp said on Tuesday it expects a 15 percent drop in third-quarter production, partly blaming Hurricane Harvey, which forced the company to stop work in the Eagle Ford shale region of Texas. Chesapeake had warned that Harvey would impact its business and said on Tuesday it expects current-quarter production to be about 542,000 barrels of oil equivalent per day- lower than it reported a year earlier. Natural gas made up about 31 percent of the Oklahoma- based company’s total revenue in the second quarter, while oil accounted for roughly 20 percent. The company now expects full-year production to range between a drop of 1 percent and an increase of 1 percent, compared with its previous view of flat to 4 percent growth.

Why U.S. Natural Gas Prices Will Remain Low

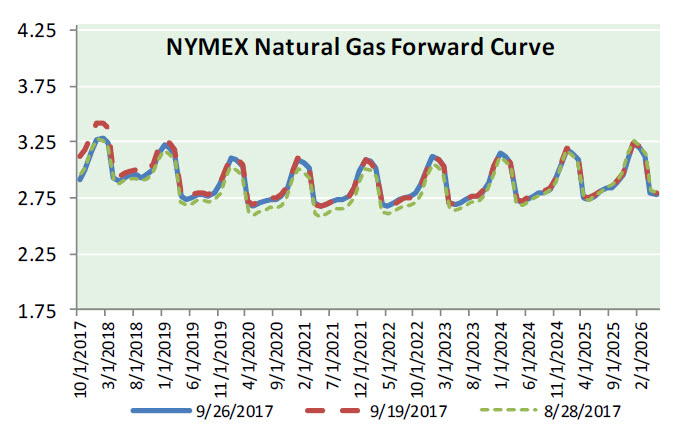

Hellenic Shipping News reported: The incredibly powerful combination of fracking and horizontal drilling has sent U.S. natural gas supplies through the roof and prices through the floor. This unstoppable rise in U.S. gas production stems mostly from an immense low cost resource base. At more than 100 years of supply, our domestic gas supply is very robust even when prices are low. An extended period of low prices has helped make the U.S. shale industry amazingly efficient, with those firms that didn’t improve operations forced out of the business. And the “shale gale” is continually leading to more oversupply. Thanks to the shale revolution, we have installed the largest and most flexible gas market in the world, capable of much more domestic demand and many more exports. We are experiencing a transformational shift in the role of natural gas, as an essential component of a clean and secure energy complex.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.