Nat Gas News – September 18, 2017

Nat Gas News – September 18, 2017

FERC Overrules New York Regulators to Allow Construction of Natural Gas Pipeline

The Washington Examiner reports: The FERC on Friday overruled New York state regulators who had blocked construction of a 7.8-mile natural gas pipeline. FERC ruled that the New York Dept of Environmental Conservation waived its right to review the Valley Lateral Project by failing to act within a year of receiving Millennium Pipeline Co.’s application for an important water-quality permit. FERC ruled that the New York Dept of Environmental Conservation waived its right to review the Valley Lateral Project by failing to act within a year of receiving Millennium Pipeline Co.’s application for an important water-quality permit. For more on this story visit washingtonexaminer.com or click http://washex.am/2xdcDQ1

Natural Gas Price Fundamental Weekly Forecast – Turns Bullish Over $3.198

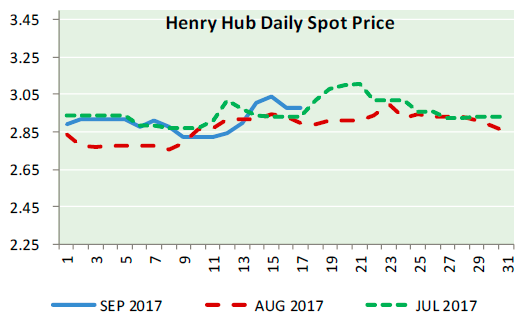

NASDAQ reports: U.S. natural gas futures closed higher last week as investors surprisingly rallied in reaction the damage caused by Hurricane Irma and Florida and as production resumed in the Hurricane Harvey-damaged Texas Gulf Coast area. The reaction to Irma was a surprise because this hurricane caused enough damage to prevent millions of Floridians from receiving electricity. Therefore, demand was low in my opinion. In other news, the EIA said in its weekly report that natural gas in storage rose by 91 billion cubic feet in the week-ended September 8. This was well above the estimate of 85 billion cubic feet. According to natgasweather.com, “Warmer temperatures will spread east this weekend and last through next week with widespread 80s and 90s for a return to stronger than normal national demand. Cooler exceptions will be across the West and far North.” Additionally, two new tropical storms are being tracked in the Atlantic Ocean. For more visit nasdaq.com or click http://bit.ly/2fc8tSo

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.