Hurricane Irma’s Impact on Fuel

With Irma now past and reconstruction beginning in Florida, it’s worth pausing and taking a look at prices in Florida to see how the storm impacted the state. Today, we’ll be analyzing a few of the ways that Irma has impacted Florida’s fueling infrastructure and prices.

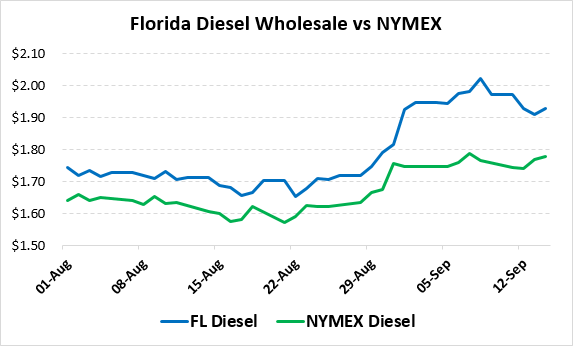

Wholesale Prices

Wholesale fuel prices in Florida have gone up significantly, though much of that has been attributable to higher NYMEX prices. For gasoline, NYMEX prices shot to 2-year highs over $2.00 as August came to an end, sending wholesale prices surging higher. On Sept 1 when prices rolled over to a new prompt month futures contract, NYMEX prices returned to normal, but prices in Florida remained high. The flood of evacuees caused lines at gas stations to stretch into the streets; demand kept prices higher state-wide. While Florida’s wholesale prices have lately been in-line with, or below, NYMEX prices, Irma sent prices to 30-cent premiums. It’s worth noting that these prices are just rack averages – prices varied widely by city and time of day, meaning the OPIS average may not always be the best index for actual prices.

Florida’s diesel prices have responded much the same way, though underlying NYMEX prices did not see the same run-up as gasoline. Florida’s diesel prices typically trade at a 5-10 cent premium to NYMEX prices; they’re currently sitting 15-20 cents higher. Overall, Florida prices have gone from roughly $1.70 before Irma to around $1.95 currently.

Retail Prices

Retail prices in Florida have seen similar price gains. Retail prices in Florida a month ago were $2.269, according to Gasbuddy. Today, they’re nearly 50 cents higher, with gasoline at $2.718. Of course, this same retail price increase has been experienced throughout the Southeast, so Florida is not alone in its high prices. They were unique, though, in how many gas stations ran out of product – at the peak of the storm, roughly half of Florida’s gas stations had no fuel. As of yesterday, that number was still at roughly 20%.

Fuel Infrastructure

Unlike Texas, which was intimately linked to most of the country’s refined product infrastructure, Florida is relatively isolated from the rest of the U.S. Nearly all of their fuel – 97% – comes from barge deliveries from other markets. Florida’s ports quickly came back online after the storm with little damage, allowing resupply to begin quickly. Although all of Florida’s fuel terminals were temporarily offline for the storm, they came back online very quickly after Irma passed. Contrast this with Texas, which still has terminals offline or without fuel.

Carrier Capacity

Distribution has been the main limitation for fuel deliveries in Florida. With nearly every fuel-buying site in Florida needing fuel after the storm, demand surged to 150% of normal demand. While carriers can traditionally meet demand in Florida, the surge of deliveries, accompanied by the hundreds of gas stations awaiting resupply, led to a rush for supply. Just like grocery store lines when everyone rushes to stock up on bread and peanut butter, fuel rack lines swelled, making each delivery take longer. Combine higher-than-average demand with longer delivery times, and you get a major bottleneck on delivery capacity. While Florida has sufficient fuel available, it does not have enough carriers to meet demand.

What Comes Next

While supply in Florida is enough to meet demand, carrier capacity will remain tight over the weekend and next week. Long hauls are still necessary, bringing fuel from other states into Florida, since carrier capacity is not quite as tight in neighboring states. Fuel carriers from all over the country are sending trucks to help meet demand in the state. The situation will continue to improve each day, as more and more carriers have availability to meet demand. Gas prices should normalize to pre-Irma levels in the coming weeks, while diesel prices may hover slightly above their pre-Irma levels. We’ll continue providing storm updates until Mansfield moves off Code Red in Florida, Texas, and the Southeast.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.