Storm Alert Update – Texas Supply Improves, Florida Supply Extremely Tight

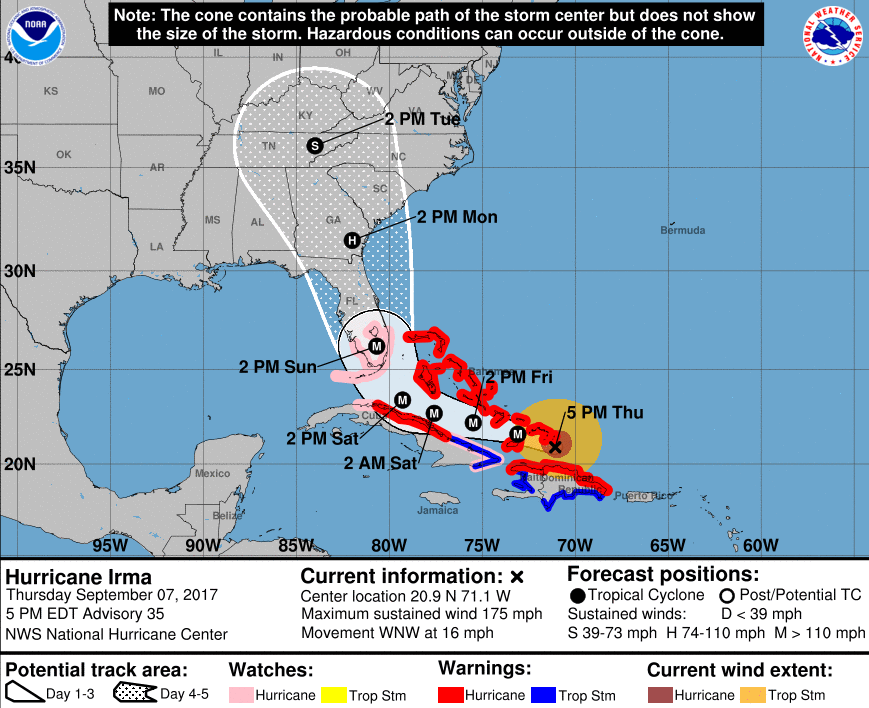

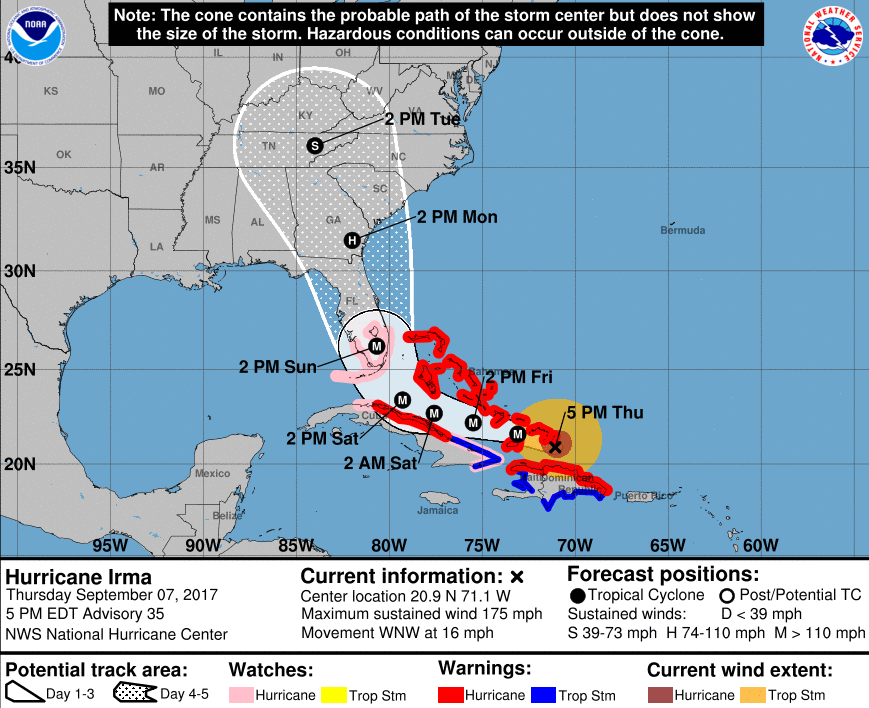

Hurricane Irma is still forecast to hit, or at least scrape, Florida, bringing catastrophic damage to Miami and along the coast regardless of the path it takes. The latest NHC models show the storm’s path hugging the eastern coastline or traveling through Florida.

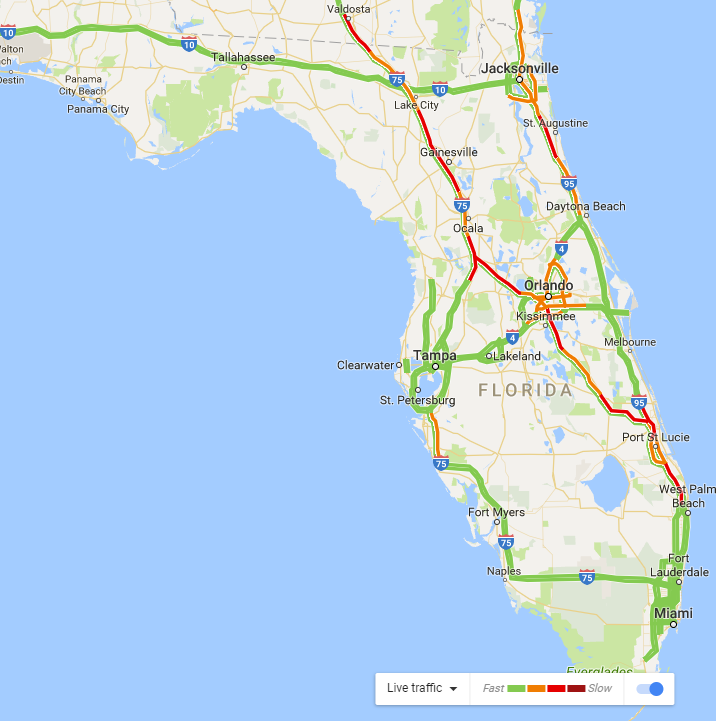

Evacuations have been ordered in several Florida counties. Google Maps shows that I-75 is experiencing heavy traffic north of Orlando, and the Florida Turnpike, running from Miami to Orlando, is also under extreme pressure. So far no highways have been reversed to allow north-bound traffic to use the south-bound lanes, though officials are considering it in certain areas. Florida is unique in that all evacuees must go north, and they only have two major highways to choose from, creating congestion throughout the state.

The fuel situation in Florida is extremely tight. Every car evacuating needs to fill up with gas, and many locations are attempting to top off their tanks before the storm hits. Mansfield has seen demand double in the past few days.

The situation has become dire. Terminal lines have reached 10 hours in some places, and the extremely congested traffic has stretched some individual fuel deliveries to take 24 hours or more! Because of the extreme slowdown in Florida, the government has commandeered some fuel trucks in the keys to guarantee supply for first responders. Mansfield remains on Code Red for the entire state.

Texas Market Updates

- Dallas: Diesel is improving daily, though gasoline remains tight. Irving is expected to reopen this weekend. Carrier capacity is still impacting deliveries.

- Houston/Pasadena: Supply is improving significantly, and we expect to move to Code Orange tomorrow, a reduced state of alarm. Carrier capacity is still impacting deliveries here, as well.

- San Antonio: Racks are expected to open more Saturday. Diesel should be nearly normal by Monday, though gasoline will take a bit longer.

- Corpus: Supply still looking better in this area, and continuing to grow healthier.

- West Texas: New Code Red area due to the shortages in San Antonio. This will likely be the last area in Texas to normalize.

Southeast Market Update

Diesel is slightly improving from previous rate reductions, but gas is still tight due to increased demand. GA, SC, and NC are expected to require long hauls through the end of next week, depending on the final path of Irma. Gas and diesel demand has been doubling normal demand along the eastern seaboard as consumers top off tanks. Expect coastal market demand to increase, putting a strain on the Charleston market.

Florida Market Update

Allocations have been cut across the board. Demand has peaked due to top-offs and panic buying. Currently the biggest impact to deliveries is evacuation traffic hindering carrier movement. Ports remain open in Florida outside of Miami, and likely will stay online until this weekend. Most supply issues are logistics-related, rather than supply – with traffic at a standstill and extremely long terminal lines, there simply are not enough fuel trucks available to move the fuel from a terminal into the ground.

Market Summary

Mansfield continues to work around the clock to help our customers fuel during the storm. If you have any questions or need to secure supply in Texas, Florida, or the Southeast, please reach out to your sales rep or customer relationship manager for more information about ordering product. Please place orders 48-72 hours in advance whenever possible, to allow time to secure supply and freight during the shortage.

Code Red (Areas with significantly reduced or unavailable supply)

- Austin, TX

- Beaumont, TX

- Buda, TX

- Dallas/Ft Worth, TX

- El Paso, TX

- Houston, TX

- Port Arthur, TX

- San Antonio, TX

- Waco, TX

- West Texas

- Southeast States (Mississippi through Maryland)

- Florida

Code Orange (Areas with limited supply availability)

- Corpus Christi, TX

- Edinburgh, TX

- Harlingen, TX

- Odessa, TX

- Lake Charles, LA

- Baton Rouge, LA

This article is part of Alerts

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.