Today’s Market Trend

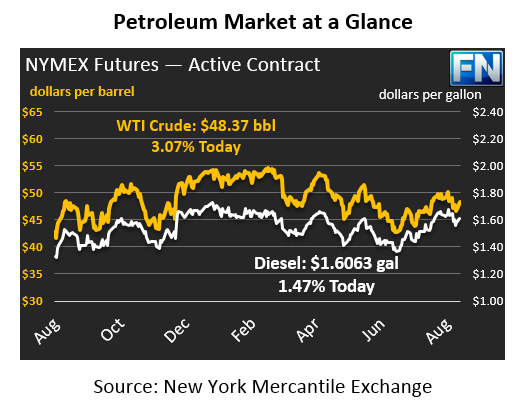

Crude prices move lower this morning, diminishing a portion of Friday’s increases. Crude prices are $48.37 this morning, losing $.14 (.29%) from Friday’s close. Prices opened at $46.93 on Friday and gained $1.58 to close at $48.51.

There was a combination of different factors that contributed to higher prices in the market late last week. Some analysts attribute the gain to a drop in rig counts. The drop could signal that production is slowing due to the current price environment. However; others would argue that the price gain occurred before the rig count was released and suspect that traders supported prices because they recognized that the market was oversold.

Refined products saw similar movement this week. Diesel prices are down over a penny since Friday, trading this morning at $1.6063. Gasoline has lost over 2 cents (1.31%) since Friday’s close, leaving prices very close to Diesel at $1.6028 currently.

Baker Hughes released rig counts on Friday, revealing that drillers cut 5 rigs in the U.S. during the week, bringing the total rig count down to 763. This is the largest drop since January 2017, demonstrating yet again a slowdown in U.S. production growth. Data showed that drillers are cutting spending plans in reaction to declining crude prices. Despite the cuts, the E&Ps still plan to spend much more this year than last.

There is still an ongoing fear that the US could impose sanctions on Venezuela. If this were to happen, the Gulf Coast would face logistical challenges as refiners typically import Venezuelan crude oil. Venezuela is the third largest exporter of oil to the US, behind Canada and Saudi Arabia.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.