Weekly Price Review

It’s been a turbulent week for oil prices. Crude prices have ranged from a high of $49.16 on Monday to a low of $46.46 on Thursday, a range of $2.70, or over 5% during the week. Compared to Monday’s open, prices have fallen $1.86 (3.8%) this week. On a weekly basis, prices have fallen between Monday’s opening price and Friday’s opening price for three weeks now. During late June through July, prices rose for five straight weeks, gaining $7.70; over the last three weeks, prices have given up $3.83, roughly half, of those gains.

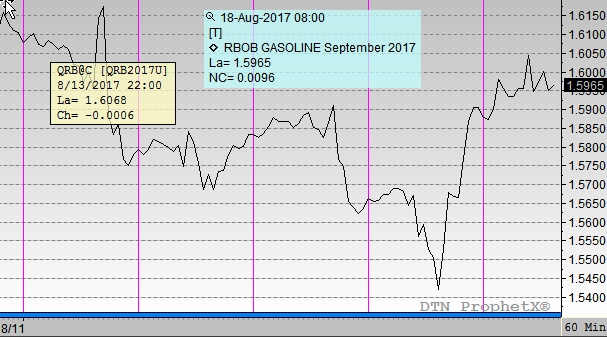

Refined products have also fallen this week, though with less force. Heating oil prices opened at $1.5802, down 5 cents (3.1%) from their opening price on Monday. Gasoline has performed more strongly, losing just 2.2 cents (1.4%) this week, likely because gasoline prices fell so precipitously last week.

The week got off to a slow start when reports indicated a slowing of Chinese oil demand. Refinery utilization and imports were down significantly, leading markets to fear a slowdown of global oil growth. The IEA expects demand to grow by 1.4 MMbbls in 2017, outpacing production growth, but a significant change in demand could alter these numbers. Without strong demand, inventories will remain high, putting a lid on prices.

Markets were perplexed on Wednesday when crude inventories saw the largest draw of the year, falling 8 MMbbls. Yet following the EIA announcement, markets fell significantly. Although the headline news from the report was firmly bullish, the details were bearish. U.S. production continues rising, and is now within a stone’s throw of hitting record highs. As global production rises, markets are watching to see whether inventories will continuously be drawn down after the summer demand seasons closes in a few weeks.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.