Excerpt: FN360° Regional Analysis, Northeast

Today, we’re sharing an excerpt from our quarterly FN360 publication. Chris Carter, a Mansfield Supply Manager, explains emerging trends that will affect Northeast consumers in the future. To read more our quarterly publication, click here.

As Chicago and Philadelphia refiners continue to fight for market share, consumers will benefit from lower regional prices. Philly refiners will also continue to push product into coastal markets as market values present opportunities. With the addition of imports into the costal markets, we will continue to see lower prices during the summer months. PADD 1B and 1A will continue to see an oversupplied market in both ULSD and Gas in Q3 2017.

Refinery War Continues in Pennsylvania

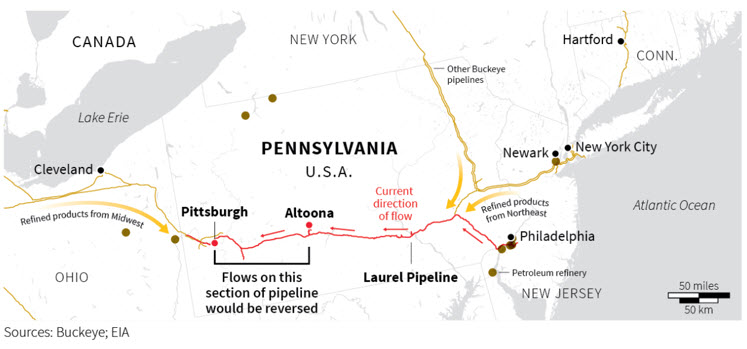

As the proposed reversal of the Laurel Pipeline between Pittsburg to Altoona progresses, refiners in Chicago and Philadelphia are fighting for market share in Central and West Pennsylvania. Buckeye Partners’ proposed reversal of product flow has East Coast refiners concerned that the entire pipeline will eventually be reversed. If the pipeline reversal continues, Midwest refiners would be able to compete with East Coast refiners by moving product into Philadelphia and the entire East Coast network.

If Midwest refined products begin flooding the Northeast market, the Northeast could become oversupplied, reducing the need to import product from the Gulf Coast and Europe and putting pressure on the price spread between New York Harbor and the Gulf Coast. When that spread narrows, so will the market that has been created for Colonial Pipeline line space. A few experts have suggested that Colonial’s Line 2, the diesel line, will go off allocation by end of 2017, making it cheaper and easier for suppliers to reach Southeast terminals. The oversupply in the Northeast may also impact imports from Europe; one report expects it to reduce European refined product imports by as much as 23%. Consumers along the entire East Coast are likely to benefit from Laurel’s pipeline reversal.

The full impact of the potential line reversal is currently unknown. However, Pennsylvania consumers are certain to benefit from lower prices as suppliers continue to fight for the market share over the next 6-12 months.

Proposed EPA budget could shut down Northeast Gasoline Supply Reserve

President Trump’s proposed 2018 budget cuts the EPA’s fiscal year budget by 31%, to $5.6 billon. This is $2.6 billion less than budgeted for 2017. The Northeast Gasoline Supply Reserve is one program potentially on the chopping block.

The reserve was created after Hurricane Sandy in 2012, which resulted in widespread supply issues in the Northeast as it caused major damage to refineries and left terminals closed due to flooding and power outages. In June 2014, the emergency stock was created to have a one-million-barrel reserve in the Northeast. The goal was to have product to help the Northeast for a few days in the event of another super storm.

The reserves are kept in three different locations, 700,000 barrels in New York Harbor, 200,000 barrels in Boston and 100,000 barrels in South Portland, Maine. The proposed budget from the White House would quickly liquidate the gasoline reserves even though the storage tanks are leased through fiscal year 2019.

The future of the NGSR is still unclear; however, Northeast residents will be paying close attention on how this could impact them if another super storm hits the Northeast markets. Consumers will benefit in the short term from abundant supply. For companies operating in the Northeast, maintaining sufficient supply during emergency situations will be more important than ever.

Pittsburg continues to fight to remove Low RVP requirement

Pennsylvania’s Department of Environmental Protection is reviewing the public comments received earlier this year for potentially removing the low RVP requirement of 7.8 lb gas for Pittsburg and surrounding markets. The agency has not yet given a time table, since the political process can be lengthy. The agency said they received eleven comments; ten of the comments supported the requirement change. The change could come as early as summer 2018; however, most believe it will be 2019 before it goes into effect.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.