Forward Markets Show Signs of Price Strength

Forecasts for the second half of 2017 include a tightening in the supply demand balance, which should be supportive for prices. It’s a little too soon to make assumptions, but yesterday the Department of Energy (DOE) released its monthly petroleum supply report for the month of May and the results were a little surprising. The DOE reports weekly inventory, production, and demand data every Wednesday at 10:30am EST. This report has strong market-moving implications as markets have been paying close attention to OPEC as well as the US production stats included in the reports.

The DOE’s revision for the month of May revealed strong US demand growth, running counter to the DOE weekly reports.

The weekly reports for May showed US oil demand down just over-1% lower than a year ago. Revisions showed that May was actually up +4%, its highest level since 2007. In addition, US demand for oil products in May was up over +800 kb/d higher than last year (gasoline up almost 2% and diesel up +6%). These numbers are supportive for oil and product prices and most likely help to explain yesterday’s late day rally.

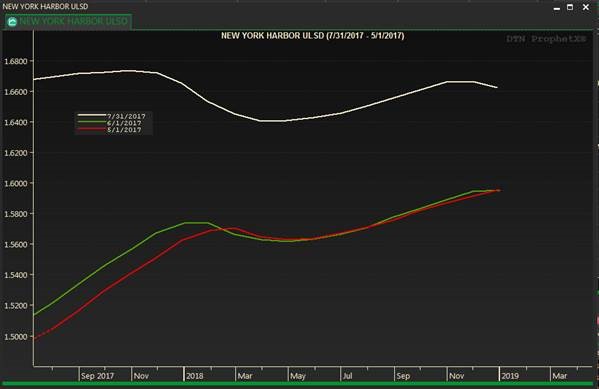

Evident by the curve (below), forward diesel prices have risen significantly. Just a month ago, forward diesel prices averaged around $1.55-$.160; that range is now $1.65-$1.70.

Consumers on the fence about the uncertainty of forward prices may want to consider reviewing their current budgeting and fuel price risk management strategies. Those looking to avoid upward price risk should take advantage of lower price opportunities as they present themselves.

If you have any questions, comments, or would like to discuss forward markets and risk management tools, please feel free to reach out. You can reach me anytime to discuss market conditions at jblanton@mansfieldoil.com, or call me at 678-207-3133

Source: NYMEX

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.