Dollar-Adjusted Oil Prices Tell a Different Story

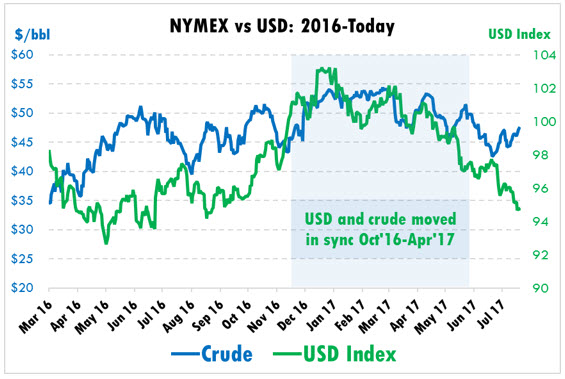

Oil prices recently have received much support from a falling U.S. Dollar. Because oil prices internationally are denominated in the dollar, changes in currency values can significantly alter global energy prices. Traditionally, the two values have had an inverse relationship – when the dollar rises, oil prices fall, and vice versa.

Interestingly, for the months following Trump’s election, oil prices seemed to track the dollar’s price movements. While the dollar received a post-election bump from the new administration, the oil market’s focus was entirely on OPEC cuts and resulting inventory draws. The inverse relationship was still a factor; oil prices rose despite significant headwinds from currencies.

The inverse relationship resumed in June, with a sharp drop in the dollar helping to push oil markets higher. As markets adjusted their focus from OPEC cuts to the broader fundamental landscape, the dollar became a more relevant market factor.

As we said before, because crude prices are denominated in dollars, movements in the dollar cause immediate value changes to crude oil. Of course, for part of the year, the negative correlation did not present itself. Looking only at the period between June 1 and today, the dollar has fallen 2.54%, while crude prices have fallen by 1.99%. Still, had the dollar not seen any fluctuation during this period, prices would be much lower than they are today. Crude prices would be just over $46/bbl, rather than surpassing $47/bbl. Had this been the case, day-to-day volatility over the past two months would have been 1.24%, rather than 1.37%.

The same chart could be manipulated to show virtually any result, depending on the date used as the base dollar price – prices could be made to look higher or lower, more volatile or less. This chart does not mean that crude prices are, in fact, higher than they should be. What it does show is the significant effect that the dollar can have on prices. Changes in the value of the dollar over the past two months has contributed $1.20 to the price of oil, pushing it from a dollar-adjusted price of $46.20/bbl to an actual $47.40. Next time you’re checking long-term oil prices, make sure you’re evaluating the market-changing effect of U.S. Dollar movements.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.