Today’s Market Trend

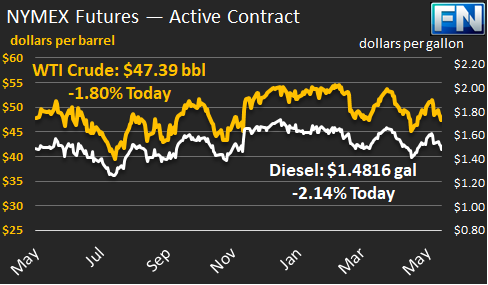

WTI crude prices have dropped to approximately $47.00-$47.50/b this morning. WTI prices languished yesterday and closed at $48.36/b. WTI opened at $48.04/b today, a decline of $0.59, or 1.21%, below yesterday’s opening price. Current prices are $47.39/b, down significantly by another $0.97 below yesterday’s closing price.

Diesel opened at $1.5001/gallon this morning. This was a drop of 2.33 cents (1.53%) below yesterday’s opening price. Current prices are $1.4816/gallon, down by 2.01 cents from yesterday’s closing price.

Gasoline opened at $1.5921/gallon today, a drop of 1.3 cents, or 0.81%, from yesterday’s opening. Prices are $1.5724/gallon currently, a continued fall of 2.9 cents from yesterday’s close.

Crude, gasoline, and diesel futures prices have opened lower for the past three sessions. Prices continued to fall despite a solid set of weekly supply data from the Energy Information Administration (EIA). The EIA reported a crude stock drawdown of 6.428 mmbbls, a gasoline stock draw of 2.858 mmbbls, and a diesel stock build of 0.394 mmbbls. The drawdown of crude inventories was smaller than the massive 8.67 mmbbls earlier reported by the API, but the EIA also reported a larger gasoline draw (2.858 mmbbls vs the API figure of 1.73 mmbbls). The EIA data showed a slightly larger diesel stock build (0.394 mmbbls vs the API’s 0.124 mmbbls). U.S. crude inventories have decreased for the last eight weeks, and this week’s stock draw was the largest of the year.

The EIA data also showed a pickup in gasoline demand just before Memorial Day. According to the EIA, gasoline demand increased by 118 kbpd during the week ended May 26, bringing demand up to an average of 9,822 kbpd. This was the highest weekly demand level on record. Naturally, the weekly data are known to show more variability than the finalized monthly data, which is published with a two-month delay. Gasoline demand this year still is below last year’s levels. The weekly data placed average May 2016 gasoline demand at 9,661.3 kbpd, around 64.8 kbpd higher than the May 2017 apparent demand of 9,596.5 kbpd.

It is possible that the Trump administration’s action to withdraw from the 2015 Paris climate accord is being interpreted as a something akin to a free-for-all on the coal, oil and gas production side. Faster growth in U.S. production of fossil energy could drive prices down further. In all, the weekly fundamentals from the EIA were solid, but investors were not at all tempted to bid prices up. Indeed, without some sort of market tightening, analysts may once again start discussing technical support levels for the next downward price correction. Recall that as recently as May 5, WTI opened at $45.51/b. What stands in the way of a return to this price?

This article is part of Crude

Tagged: crude prices, diesel prices, gas prices, Oil pices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.