Today’s Market Trend

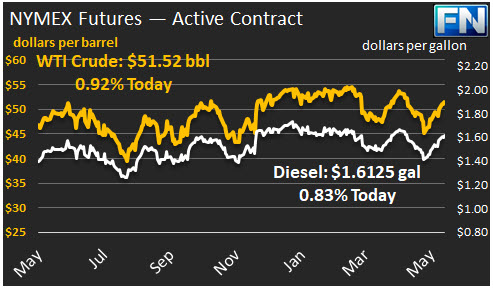

WTI crude prices have strengthened to approximately $51.50/b this morning. WTI opened at $51.44/b today, an increase of $0.40, or 0.78%, above yesterday’s opening price. Current prices are $51.52/b, $0.05 above yesterday’s closing price. Product prices opened higher during the current session and are trending up in early morning trading.

Diesel opened at $1.6101/gallon this morning. This was an increase of 0.97 cents (0.61%) above yesterday’s opening price. Current prices are $1.6125/gallon, an increase of 0.58 cents from yesterday’s closing price.

Gasoline opened at $1.6685/gallon today, up 0.56 cents, or 0.34%, from yesterday’s opening. Prices are $1.6688/gallon currently, up 0.74 cents above yesterday’s close.

The American Petroleum Institute (API) reportedly expects a drawdown in crude inventories of 1.5 mmbbls, falling short of the Schneider Electric survey calling for a 2.7 mmbbl drop. The API data shows a gasoline drawdown of 3.15 mmbbls, well above the expected 0.8 mmbbls from the survey. API also reported a distillate drawdown of 1.85 mmbbls, while the survey expected a build of 0.3 mmbbls.

Prices for crude, diesel and gasoline have opened higher for five consecutive sessions. OPEC and key Non-OPEC oil producers are meeting in Vienna today to make a long-awaited decision as to whether the January-June production cut agreement should be extended, and if so, for how long, and at what levels for the various participants. OPEC’s statements have been very positive, giving the market faith that the cuts will be extended. The consensus expectation is for a nine-month extension.

As the meeting gets underway, our second article today provides a country-by-country look at OPEC compliance with the cuts. Our country-level charts compare actual monthly production for the first four months of 2017 with the pledged production levels. Therefore, it is possible to see which OPEC countries are in compliance, which have headed toward compliance by reducing output over the past four months, and which have been heading in the wrong direction. It is also evident that without Saudi Arabia, the group’s overall compliance level would have been poor. Saudi Arabia routinely has been cutting its production 500-600 kbpd below its original pledge.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.