Today’s Market Trend

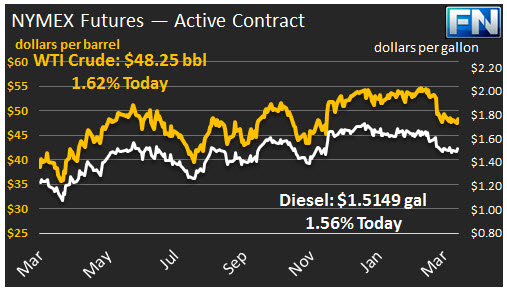

WTI crude prices recovered the $48/b mark this morning. Prices yesterday once again tested lows of $47/b before buying interest picked up. WTI opened at $47.89/b today, a drop of $0.23 below yesterday’s opening. Prices increased to $48.25/b currently, up $0.52 from yesterday’s close. Product prices also dipped yesterday and recovered overnight.

Diesel opened at $1.501/gallon in today’s session. This was a decline of 0.18 cents (0.12%) below yesterday’s opening price. Current prices are $1.5149/gallon, up 1.24 cents from yesterday’s close.

Gasoline opened at $1.6175/gallon today, an increase of 0.66 cents, or 0.41%, from yesterday’s opening. Prices are $1.6345/gallon currently, up 1.56 cents from yesterday’s close.

The OPEC/Non-OPEC Monitoring Committee met in Kuwait over the weekend. The committee is considering recommending an extension of the production cut agreement. The group will meet again next month. Russia indicated that it was too soon to commit to an extension. The current agreement is only half way through its six-month term. Goldman Sachs has noted that progress is being made toward oil supply/demand balance despite the crude inventory build in the U.S. Goldman Sachs believes that extending the cuts could be counterproductive. Still, Iran indicated that an extension was likely, which gave a boost to prices. Libyan output also has been reduced by renewed violence.

The EIA has released its data on U.S. Retail Gasoline and Diesel Prices for the week ended March 27th. At the national level, gasoline prices declined by 0.6 cents/gallon, while diesel prices declined by 0.7 cents/gallon. Retail fuel prices remained more robust than crude prices during the week. Details are presented in our second article today.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.