Today’s Market Trend

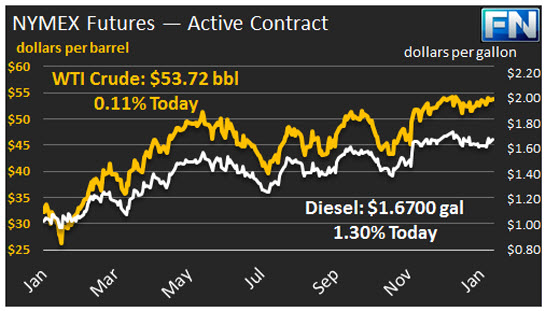

WTI crude prices are remaining strong in the $53.50-$54/b range this morning. WTI opened at $53.81/b today, an increase of $0.13 from Friday’s opening price. Price rose above $54/b overnight, but have receded this morning. Current prices are $53.72/b, $0.11 below Friday’s close. Product prices showed a similar pattern with overnight strengthening and a slight retreat this morning.

Last week’s supply-demand fundamentals were bearish: another across-the-board stock increase, weak demand, and another increase in the active rig count. Baker Hughes reported Friday that the active rig count rose by 17, following an increase of 18 rigs the prior week, and 35 rigs during the week ended January 20th.

Nonetheless, prices have remained strong. OPEC’s success at cutting crude production is providing the first pillar of support for prices, but a new pillar has been added by the rise in geopolitical tensions between the U.S. and Iran. Following an Iranian ballistic missile test, President Trump signed an executive order imposing sanctions on certain Iranian individuals and entities. The new Executive Branch in the U.S. already is proving ready to act quickly and unilaterally. This will create a more volatile environment for oil prices.

Distillate opened at $1.6724/gallon in today’s session, an increase of 1.38 cents from Friday’s opening. Current prices are $1.67/gallon, up 0.49 cents from Friday’s close.

RBOB opened at $1.555/gallon today, a increase of 1.9 cents from yesterday’s opening. Current prices are $1.5564/gallon today, up 0.27 cents from Friday’s close.

This article is part of Daily Market News & Insights

Tagged: distillate, gasoline, prices, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.