Oil Prices Hold Steady as Market Weighs Tariffs and Supply Disruptions

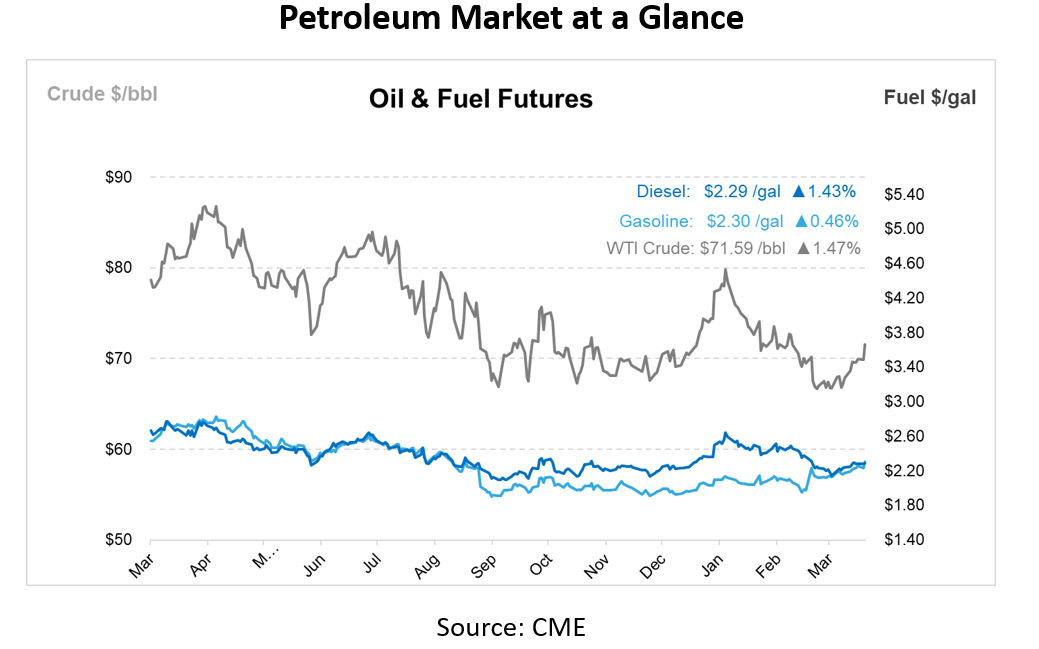

Oil prices are holding steady near five-week highs as the market weighs growing geopolitical tensions against concerns about global economic slowdowns. Brent crude is trading just below $75 per barrel, while U.S. West Texas Intermediate sits around $71, both slightly down after strong gains the previous day.

Recent comments from U.S. President Donald Trump have added significant uncertainty to the market. Trump announced intentions to impose secondary tariffs of 25% to 50% on buyers of Russian and Iranian oil unless those countries comply with U.S. demands related to the war in Ukraine and Iran’s nuclear program. Such measures would directly affect major importers like China and India and could disrupt global crude flows. Trump also indicated a willingness to escalate pressure through sanctions or military action if Iran fails to return to nuclear negotiations. Meanwhile, Washington continues its clampdown on Venezuela, revoking permits that have contributed to a drop in Venezuelan oil exports.

At the same time, supply concerns are increasing due to disruptions in Kazakhstan. Russia has ordered the shutdown of two out of three mooring units at the Caspian Pipeline Consortium terminal following an environmental inspection. The suspension is expected to last more than a month and will reduce Kazakhstan’s oil exports via the Black Sea. This disruption comes amid rising tensions within OPEC+, the alliance of oil producers led by Saudi Arabia and Russia. OPEC+ is scheduled to meet on April 5 to review its production policy and is currently on track to increase output by 135,000 barrels per day in May, following a similar hike in April.

Despite these supply-side issues, demand signals are mixed. A Reuters poll of 49 economists suggests that oil prices will remain under pressure due to weak economic activity in key markets such as China and India. The risk of a broader trade war, triggered by new U.S. tariff proposals, adds to concerns about reduced energy demand. In the U.S., economic forecasts have been revised downward, and the probability of a recession has increased to 35% due to the potential impact of trade restrictions.

However, some indicators remain supportive of prices. U.S. crude inventories are expected to have declined by about 2.1 million barrels last week, according to a Reuters survey of analysts. Jet fuel demand is also showing year-over-year growth, and Chinese oil consumption is forecast to rise slightly in 2025 due to stronger-than-expected economic performance and increased petrochemical demand. In January, the U.S. recorded its highest crude import levels for that month since 2019, driven by increased flows from Canada.

The latest sanctions on Iran also reflect Washington’s growing push to isolate Tehran economically. Rystad Energy notes that Iranian exports are still flowing—mostly to China—but further pressure from the U.S. could change that. While the sanctions have not yet reached a “maximum pressure” scenario, any move toward cutting Iran’s exports to near zero would tighten supply and potentially push prices higher. At the same time, this could benefit other OPEC+ members with spare capacity, making it easier for them to manage their own output targets.

In this environment, short-term risks remain tilted toward higher prices due to geopolitical instability and infrastructure issues, while medium-term outlooks remain cautious due to demand-side headwinds. The market continues to react to every new development, with no clear direction as multiple forces pull in opposite directions.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.