Tariffs Policy Update: What It Means for Cross-Border Energy Trade

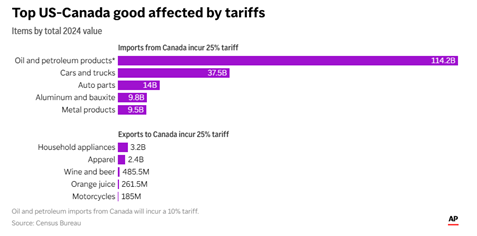

The White House has implemented new tariffs policy under President Donald Trump, targeting imports from Canada, Mexico, and China. As of March 4, a 25% tariff applies to most goods from Canada and Mexico, while Canadian energy products are subject to a lower 10% rate. The move is part of a broader strategy to address trade imbalances and reinforce national security, with the measures linked to ongoing reviews of border security, with U.S. officials citing issues like drug trafficking and trade imbalances as reasons for the action.

Canada, Mexico, and China have economies that rely heavily on trade, with exports and imports accounting for 67% of Canada’s GDP, 73% of Mexico’s GDP, and 37% of China’s GDP. By comparison, trade represents just 24% of U.S. GDP. Despite this smaller reliance, the U.S. had a goods trade deficit exceeding $1 trillion in 2023 — the largest in the world.

Tariffs policy and the Oil & Gas Industry

The energy sector—particularly the oil and gas supply chain between the U.S. and Canada—is expected to feel the effects of these new tariffs. While Canadian crude has been granted a reduced 10% tariff, the costs will still impact both U.S. refiners and Canadian producers.

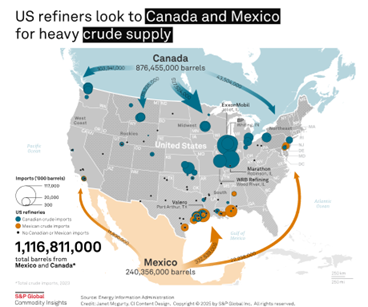

According to S&P Global, these two industries are deeply connected. Around 70% of Canadian crude is exported to the U.S., and roughly 60% of U.S crude imports come from Canada. Much of this crude is a heavier blend, which is not commonly produced in the U.S. but is essential for the operation of complex U.S. refineries, especially in the Midwest and Rocky Mountain regions.

The U.S. currently refines about 18.4 million barrels of crude oil per day, but domestic production stands at approximately 13.4 million barrels per day. That 5-million-barrel shortfall is largely covered by imports. According to the EIA, Canada accounted for 4.2 million barrels per day in December.

Who Pays the Tariff?

In some cases, Canadian exporters reduce prices to remain competitive, but their limited access to alternative markets outside North America makes this difficult.

The Western Canadian Select (WCS), for instance, typically trades at a steep discount to West Texas Intermediate (WTI) due to quality differences and transportation constraints from Alberta to U.S. refineries. This discount has ranged from $10 to $25 per barrel, depending on market conditions. With the U.S. considering a 10% tariff on Canadian crude, Canadian producers may be forced to offer even deeper discounts to remain competitive, especially as U.S. refiners explore switching to lighter, domestic shale oil. While the cost of the tariff could be negotiated and shared between producers and refiners on a case-by-case basis, the added burden may strain Canada’s energy exports and shift market dynamics.

The White House has issued exemptions for producers who can prove compliance with the United States-Mexico-Canada Agreement (USMCA), but imports have already started to fall. U.S. crude imports from Canada dropped to 3.1 million barrels per day — the lowest level since March 2023.

Inventory and Market Response

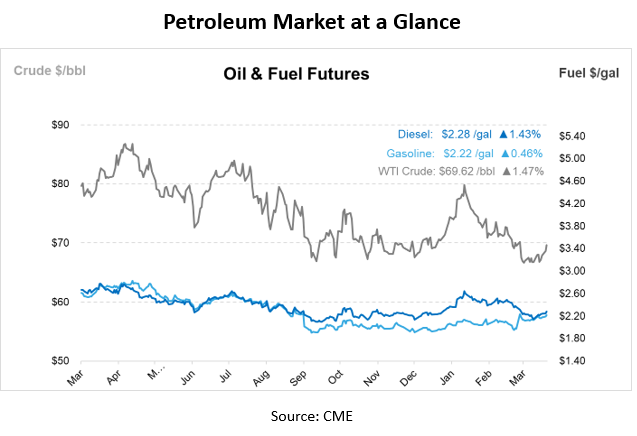

Despite the decline in imports, U.S. crude inventories rose by 1.7 million barrels in the week ending March 14, according to the Energy Information Administration (EIA). Domestic crude production remains strong at 13.6 million barrels per day, helping to buffer the drop in Canadian imports. However, refinery utilization on the East Coast has slipped to its lowest point since mid-2020.

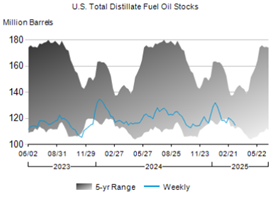

Distillate inventories — which include diesel and heating oil — fell by 2.8 million barrels to 114.8 million barrels, and gasoline stockpiles also dropped. While the market responded with slight gains in crude futures, the broader industry remains cautious about the longer-term impact. Depending on the region, some areas like the extreme Northeast may face higher costs due to limited U.S. infrastructure options.

Looking Ahead

President Trump acknowledged there may be some “adjustment period” as markets react. The full effects of these tariffs policy — from shifts in crude trade flows to cost changes at the pump — will depend on how long the measures remain in place, and whether exemptions expand or contract.

According to our latest Week in Review article, President Trump’s recent closed-door meeting with oil executives added to the complexity of the energy landscape. The discussions sparked industry conversations around energy independence, permitting reform, and the potential role of tariffs. While the administration stressed the importance of increasing domestic production, energy executives quietly expressed concerns that trade tensions and policy uncertainty are making it harder to plan future investments.

This article is part of Daily Market News & Insights

Tagged: Canadian Crude, Cross-Border Trade, Crude Tariffs, Distillate Stockpiles, Energy Policy, Energy Supply Chain, International Trade Policy, Oil and Gas Imports, Oil Market Impact, Refinery Utilization, Trade Imbalance, Trump Administration Policy, U.S. Crude Inventories, U.S. Energy Independence, U.S. Refining Capacity, U.S.-Canada Energy Trade, USMCA, Western Canadian Select

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.